Press Releases

Press Releases

Datalogic (Star: DAL) - Datalogic Group 2013-2015 Business Plan Approved

|

• Despite the ongoing slowdown in the sector, the Datalogic Group will continue to grow at a faster rate than expected of the market, confirming its capacity for innovation and growth Bologna 27th September 2013 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved yesterday the Group’s 2013-2015 Business Plan.

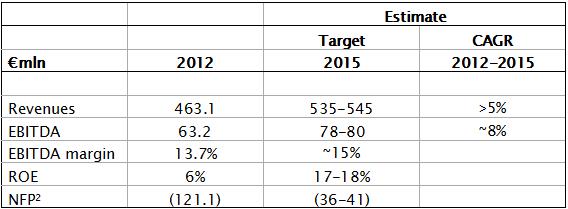

Strategic drivers The extension of the plan to 2015 is based on a worse environment than the scenario expected last year, when the Automatic Data Capture (ADC) market, including the POS Retail (barcode readers for the retail market), Hand Held Scanners and Mobile Computers segments, contracted by 3.5%, while the more fragmented Industrial Automation (IA) market remained broadly stable (Available Market: +0.9% YoY). The estimated global 2012-2015 CAGR is approximately 1%[3] for the ADC market and approximately 7%[4] for the IA market. This growth rate is the combined result of another muted performance in 2013 as a result of the global macroeconomic crisis and a more sustained recovery in the last two years of the plan. In such a changed environment, the ability to provide concrete responses to customers through continuous product innovation and the management of core technologies becomes increasingly important. To this end, and to ensure the future of Datalogic as an Italian high-tech group operating on a global scale, the new Business Development division has been established and organised into three areas: - New needs and application scouting: this collects the inputs of the main customers and transmits them to both divisions; - Datalogic Labs: preserves and improves the Group’s technological assets and develops new technologies and applications; - Mergers & Acquisitions: carries out scouting and valuation activities in relation to operations intended to enable the Group to grow, both in terms of size and through new technologies. Annual investment in R&D will be around 8% of revenues (compared with 7% in the previous plan). Thanks to the activities of the new division, the new 2013-2015 Business Plan will be customer-focused, leveraging the Group’s unique position as leader in both its core markets, ADC and IA. The improvements expected in customer service management, quality and efficiency, and the launch of highly innovative products like Jade (the self-checkout designed to optimise supermarkets’ front-end functions, which is currently undergoing testing among our clients) and the scanner equipped with imager technology, will be the main growth drivers in the Retail sector, which currently accounts for more than 40% of the Group’s revenues. In the Manufacturing sector, which generates 35% of Group revenues, investment will continue in order to develop imaging solutions, machine vision technology and miniaturised technology for sensors, which will enable the Group to acquire market shares within the Factory Automation (FA) market. Renewed impetus will be given to the sale of mobile products within warehouse management and the development of new laser technologies, also leveraging the know-how of the newly-acquired Multiwave Photonics. Boosted by the integration of Accu-Sort last year, in the Transportation and Logistics sector, which accounts for 17% of revenues and is dominated by large contract orders, the focus will be on the postal, courier and distribution centre segments, with the launch of new solutions with machine vision technology. The Group will complete the development of new products, such as the newly-launched dimensioner, and will strengthen its presence in the sector through new partnerships. Finally, Datalogic will increase its presence in the promising Healthcare sector, again through new laser and vision technologies. As regards international expansion, while the T&L sector will focus mainly on increasing its penetration in North America and thereafter in Europe, the real challenge of the new three year plan for other sectors will be growth in fast-growing markets, particularly China and Brazil, where the Group expects to register a 2012-2015 CAGR of 12%, higher than the market rate forecast. Growth will mainly be achieved by strengthening local sales forces, opening new offices directly, and, not included in the plan, through potential new partnerships and acquisitions. Moreover, the Group will place a greater emphasis on the growth and optimisation of human resources, its fundamental strategic resource, through a focused strategy of development and motivating and competitive incentive plans. Based on these lines of development, the Datalogic Group forecasts that in 2015 it will register consolidated revenues between €535 million and €545 million, with a 2012-2015 CAGR of over 5%, a CAGR of approximately 4% for the ADC division and of more than 10% for the IA division. Through gains in efficiency and productivity and the synergies resulting from the integration of acquired companies into Datalogic Automation, and despite growing investment in R&D, in 2015 the Group expects to reach an EBITDA between €78 million and €80 million, with a 2012-2015 CAGR of approximately 8% and an EBITDA margin of approximately 15%. Thanks to continued cash flow generation of €80-85 million, net financial debt (calculated gross of expected dividends) is seen to improve in a range between €36 million and €41 million, with a net debt/EBITDA ratio of around 0.5x in 2015. In terms of Capex, investments will continue at an ordinary rate of 2% annually. The measures outlined in the Business Plan will enable the Group to achieve high levels of profitability and value generation, with double-digit growth expected in ROE, which is forecast to come in at around 17-18% at the end of the period. *** [1] Gross of expected dividends [2] Gross of expected dividends [3] Source: VDC 2013, base year 2012 [4] Source: VDC 2013, base year 2012 and internal estimates based on sector research |