|

• Datalogic recorded strong growth in 2010:

- Sales revenue up 25.9% to €392.7 million, compared to €311.9 million in 2009

- EBITDA more than doubled to €49.8 million versus €19.6 million in the previous year, with an EBITDA margin of 12.7%

- Net profit at €18.0 million, versus a loss of €12.2 million in 2009.

• Improved net financial debt to €76.5 million, versus €100.5 million at 31 December 2009 (it would be negative by € 55.5 million without the acquisition of Evolution Robotics Retail Inc.).

• Dividend proposed of 15 euro cents per share (payout ratio of 49%).

Bologna, 7th March 2011 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the Star segment of Italy’s stock exchange (MTA) organised and managed by Borsa Italiana SpA (“Datalogic”) and market leader in barcode readers, data collection mobile computers, RFID and vision systems, today approved the draft financial statements for the year ending on 31st December 2010.

Datalogic closed 2010 with a consolidated net profit of €18.0 million, a marked trend reversal compared to 2009, when it recorded a loss of €12.2 million. This extremely positive result indicates the effectiveness of the strategic decisions taken and the company’s capacity to implement long-term plans.

Mauro Sacchetto, CEO of Datalogic, commented: “We can only be satisfied with the results recorded in 2010, the best ever achieved by the Group and obtained in a market environment that remains extremely difficult. These figures again confirm Datalogic’s capacity to look beyond current circumstances, anticipate future market scenarios and fully seize all growth opportunities worldwide.

Our objectives for the next few years are clear and defined, and will again see the Group in a leading role, strengthening its presence on the markets with the biggest growth margins, such as ADC and Industrial Automation. Furthermore, with the strength of an efficient, truly multinational and highly technologically specialised Group, we are convinced that we can grow in markets considered marginal up to now, but which are recording very strong growth, greater than Europe and the US, such as BRIC countries.

The continued and constant investments made over the years in Research and Development and the implementation of high-value technological solutions have finally enabled us to record higher growth rates than our reference markets, at approximately 8%, gain market share on our main competitors and meet the targets we set ahead of time”.

In 2010, sales revenue came in at €392.7 million, up 25.9% versus €311.9 million recorded in 2009. At constant euro/dollar exchange rates, the increase versus the previous year would have been slightly lower at 23%.

EBITDA rose to €49.8 million, more than double the €19.6 million reported in 2009, and with an EBITDA margin at 12.7% compared with 6.3% in the previous year. This result includes operating costs of €143.2 million (up 13% from €126.3 million in 2009), which were affected by non-recurring costs of €461 thousand relating to the acquisition of Evolution Robotics Retail Inc., and higher variable costs attributable to growth in revenue (+26% versus 2009) and mainly comprising sales and marketing expenses, bonuses and fees.

Research and Development costs totalled €26.3 million, equivalent to around 7% of revenue.

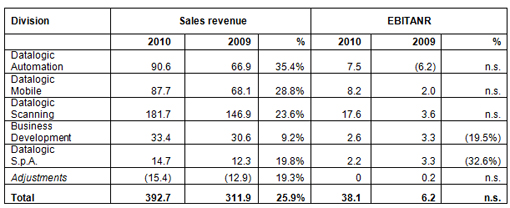

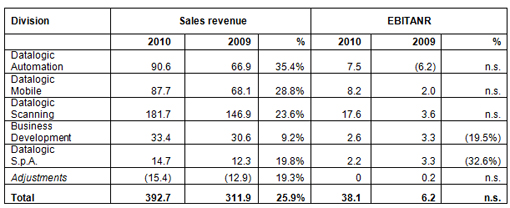

EBITANR¹ was €38.1 million, compared to €6.2 million in 2009.

Financial charges totalled €6.7 million, compared to €6.4 million in 2009, while exchange rate losses fell from €0.7 million to €0.2 million. After taxes of €10.2 million, net profit came in at €18.0 million, compared with a loss of €12.2 million in the previous year.

Net financial debt at 31st December 2010 was €76.5 million, a significant improvement compared to €100.5 million recorded at 31st December 2009, thanks to strong cash generation in the second half of the year, and despite the acquisition of Evolution Robotics Retail on 1st July 2010, which required an outlay of €20.96 million. Note in particular the high operating cash flow generation of €34.3 million resulting from the positive trend in operating profit and the reduction of trade working capital of €2.7 million.

Net working capital amounted to €27.3 million at 31 December 2010, decreasing by €15.9 million versus € 43.2 million at 31 December 2009.

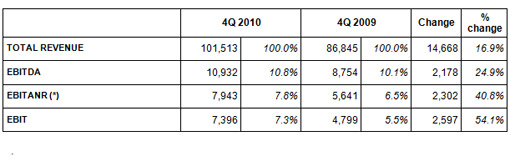

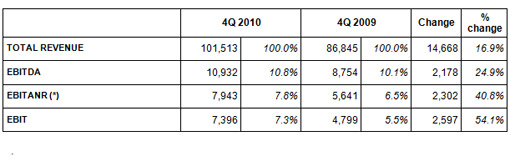

The fourth quarter of the year also confirmed the positive trend, with sales revenue up to €101.5 million (+16.9% versus the fourth quarter of 2009), EBITDA up 24.9% to €10.9 million and net profit almost doubled versus the fourth quarter of 2009 to €3.5 million.

All the Group operating divisions recorded very sustained growth in their results for the year, both in terms of sales revenue and profit. The three main divisions highlighted a strong upturn in profitability, each showing an EBITDA/sales revenue ratio of around 12%.

The Datalogic Automation Division, specialized in the production of barcode, RFID and vision automatic identification systems and which accounts for 23% of consolidated revenue, registered growth of 35.4% versus 2009, with revenue of €90.6 million (€26 million in 4Q 2010, +40.5% y/y).

Datalogic Mobile, specialized in the production of mobile computers and which accounts for 22% of consolidated revenue, recorded growth of 28.8%, with sales revenue of €87.7 million (€24.6 million in 4Q 2010, +9% y/y).

The Datalogic Scanning Division, specialized in the production of bar code readers for the retail market and hand held scanners, and which accounts for 46% of consolidated revenue, booked growth of approximately 24%, with revenue exceeding €181.6 million (€43.5 million in 4Q 2010, +13% y/y).

The Business Development Division (which includes Informatics Inc. and the newly-acquired Evolution Robotics Retail Inc.) achieved growth in revenue of 9% to more than €33 million.

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) by segment in 2010.

All geographical regions grew in 2010 versus the previous year, particularly Asia Pacific (+64%) and the Rest of the World (+59%).

Events during the year

On 1st July 2010, the Group signed an agreement to acquire Evolution Robotics Retail Inc., a company based in California (USA) with unique expertise in visual pattern recognition technology for retail applications intended to prevent theft and loss, and consequently increase productivity. The value of the transaction was USD 25.5 million.

On 4th October 2010, the Board of Directors approved the 2010-2012 3-Year Plan.

******

At the ordinary shareholders’ meeting scheduled for 28th April 2011, the Board of Directors will propose the distribution of an ordinary dividend, gross of legal withholdings, of 15 euro cents per share, for a maximum amount of €8.76 million (with coupon detachment on 2nd May 2011 and payment on 5th May 2011).

The Board of Directors also approved the Annual Corporate Governance Report. A copy of the report will be made available to the public in accordance with applicable law.

Note that the auditing of the draft financial statements has not yet been completed and that the independent auditors’ report will be made available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Finally, the Annual Financial Report (pursuant to article 154-ter of the Testo Unico della Finanza - TUF) of Datalogic S.p.A. will be made available to anyone who requests it at the company headquarters or at Borsa Italiana SpA, and may also be consulted on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations.

The manager responsible for preparing the company’s financial reports - Dott. Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

(¹) EBITANR – Earnings before interest, taxes, acquisition and non recurring

|