|

• Sales revenues up 8.6% to €462.3 million, compared to €425.5 million in 2011

• EBITDA increased to €62.7 million versus €59.2 million in the previous year, with an EBITDA margin of 13.6%

• The partial impairment of the goodwill of Accu-Sort Systems amounting to €27 million resulted in net profit falling to €9.9 million, compared to €25.9 million in 2011; net of this impairment net profit would have increased by 20% to €31.1 million

• Negative net financial position of €121.1 million, compared to €59.4 million at 31 December 2011 following the acquisition of Accu-Sort Systems completed in January 2011

• Dividend proposed of 15 eurocents per share (88% payout ratio)

Bologna, 7th March 2013 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data acquisition and industrial automation markets and producer of bar code readers, data collection mobile computer, sensors, vision systems and laser marking systems, today approved the draft and the consolidated financial statements at 31 December 2012.

The 2012 results show that revenue performance has remained very steady at €462.3 million (up 8.6% and down 0.7% net of the contribution of Accu-Sort Systems and PPT Vision, compared to the previous year) and an increase in EBITDA which reached €62.7 million (up 6% compared to 2011). These results are significant as they were achieved in an international macroeconomic scenario which remained uncertain. The weak demand of the target markets, particularly the Industrial Automation market consisting mainly of medium-term orders in the Transportation & Logistics segment in particular, resulted in the growth outlook of the newly acquired American company Accu-Sort Systems being revised and its goodwill consequently being impaired. The Group therefore closes 2012 with a consolidated net profit of €9.9 million, compared with €25.9 million the year before. Net of this item, which involved no cash outlays by the Group, the net result would have been €31.1 million, which is 20% higher than in the previous year.

The Chairman and CEO of Datalogic Group, Romano Volta, commented: “Despite the international market context which continues to be uncertain and which resulted in a decrease in revenues for Datalogic’s main competitors, 2012 essentially confirmed, in terms of revenue, the positive results achieved the year before and saw the Group’s EBITDA improve further. This trend once again confirms the soundness of the organizational and management structure of the Company, which will enable it to handle future challenges with ease and build the basis for further growth.

Datalogic confirms its role as a global company with an international vision, able to compete in all the most strategic areas of the world, offering hi-tech products able to meet the needs of our commercial partners.

I conclude by saying that in 2012 Datalogic succeeded in increasing investments in Research & Development, a choice that we believe to be fundamental to continue offering excellent solutions which are appreciated by our customers, which is essential for maintaining international leadership in target markets”.

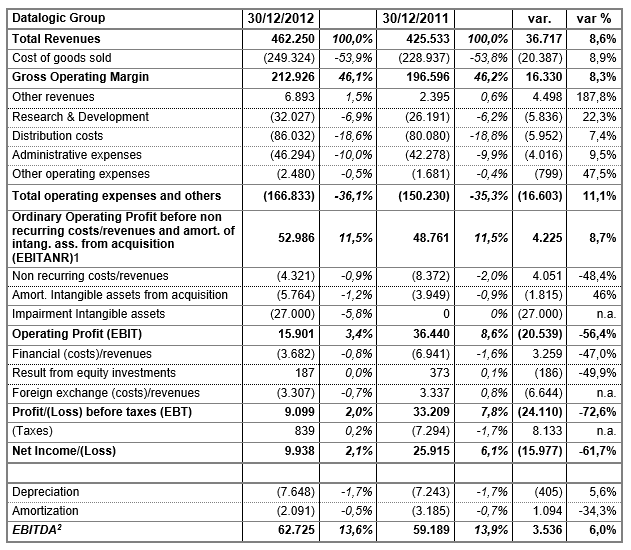

In 2012, sales revenues came in at €462.3 million, up 8.6% versus €425.5 million for the previous year. Revenues benefitted from the trend of the dollar: at constant euro/dollar exchange rates, the increase versus the previous year would have been 4.3%. Sales revenues incorporates the revenues of Accu-Sort Systems and PPT Vision totalling €39.7 million.

Operating costs, amounting to €166.8 million, were up 11.1% versus €150.2 million in 2011 and include higher costs for Research & Development, which increased to 6.9% on revenues, compared to 6.2% for the previous year.

EBITDA rose to €62.7 million, up 6% compared to €59.2 million in 2011 and with an EBITDA margin at 13.6% compared to 13.9% in the previous year. This result includes one-off costs for M&A activities amounting to €2.2 million. Net of these costs EBITDA would have been €64.9 million, up 9.7% and an EBITDA margin of 14%.

EBITANR was €53 million, compared to €48.8 million in 2011, up 8.7%.

As mentioned above, the uncertain market demand in the target sectors of the Industrial Automation Division and, in particular, the Transportation & Logistics segment, led to a revision of the growth outlook of the company Accu-Sort Systems and therefore also of the present value of the future cash flows used to determine the goodwill value.

The impairment valuation then underwent a revision, reducing the goodwill value stated on the acquisition date at a value of €69.4 million, of €27 million.

This impairment had an impact on the Operating Result which increased to €15.9 million from €36.4 million in 2011. Net of this impairment the Operating Result would have been up by around 18%.

Financial charges came in at €3.7 million, compared to €6.9 million in 2011, while there were foreign exchange losses of €3.3 million compared to the exchange gain of €3.3 million for the previous year. Net profit came in at €9.9 million, compared to €25.9 million achieved in the previous year. Net of the impairment of the goodwill of Accu-Sort Systems, the net result would have been €31.1 million, up 20%.

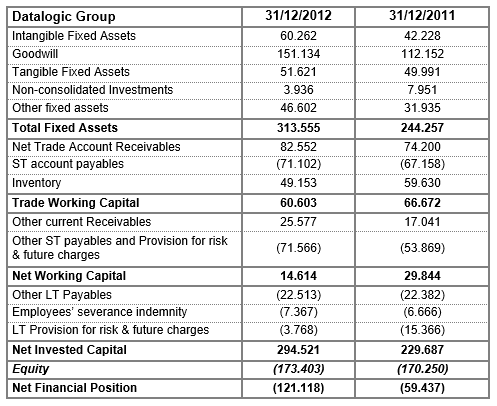

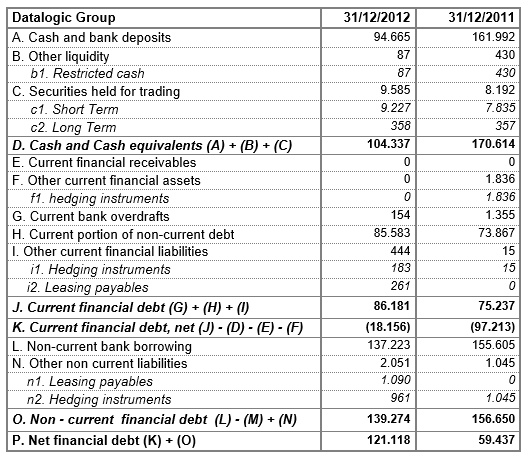

There was a negative net financial position at 31 December 2012 of €121.1 million, compared to €59.4 million at 31 December 2011. This change was mainly due to the purchase of the shareholding in the Accu-Sort Systems Group for €100.3 million. Thanks to the steady production of cash the net financial position nevertheless improved compared to 30 June 2012, where it was €-171.8 million.

Trade working capital (customer trade receivables + inventory – trade payables) was €60.6 million at 31 December 2012 (down €6 million compared to the previous year) and accounted for 13.2% of revenues (a great improvement on the 15.7% in the previous year).

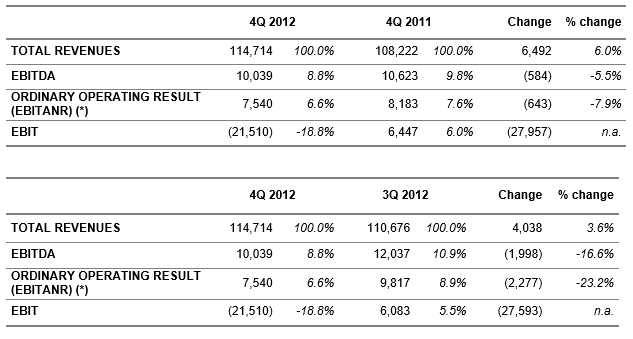

The fourth quarter of the year saw signs of recovery from the previous one in terms of growth in revenues, which rose to €114.7 million (up 3.6% compared to the third quarter of 2012 and up 6% compared to the fourth quarter of 2011). EBITDA, down to €10 million, was also affected by non-recurring costs of €1.6 million for one-off M&A expenses.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

Since January 2012 the Group’s new organizational structure, broken down into target markets and designed in such a way as to provide global integrated solutions, has been operational. The Group is organized as follows:

• Automatic Data Capture (ADC) Division - includes Datalogic Scanning, Datalogic Mobile, Enterprise Business Solutions and Evolution Robotics Retail Inc.

• Industrial Automation Division – includes Datalogic Automation (which incorporated the newly-acquired companies Accu-Sort Systems and PPT Vision from 1 July 2012)

• Informatics

The ADC Division registered revenues of €297.9 million, substantially in line with the €297.5 million achieved in the previous year. Both the EBITDA and the EBITANR of the Division – €46.3 million and € 40.6 million respectively – greatly increased (up 15.4% and 19.6% compared to last year). These results are mainly due to the new Supply Chain of the ADC segment, which allowed all operations processes (production and logistics) to be integrated, enabling significant boosts to efficiency and cost savings.

In 2012 the Datalogic Group confirmed its leadership position on the retail market worldwide mainly because of scanners in the Magellan product line and on the European market of manual scanners, mainly because of a 19% growth in industrial products. The range of fixed scanners saw the addition of the new Magellan™ line, which is in fact the number one POS (Point of Sales) scanner in the world, and a brand new, revolutionary automatic checkout system was launched, aimed at major retail operators.

The Industrial Automation Division achieved revenues of €130.6 million, compared with €96.2 million recorded the year before. This increase is the result of the contribution of the acquisitions of PPT Vision and Accu-Sort Systems amounting to €39.7 million. Profitability both in terms of EBITDA (falling from €13.7 million to €7.1 million) and EBITANR (from €11.1 million to €4.6 million) decreased overall due to the fall in demand and the important process of integrating the new companies into the Group’s business, aimed at enhancing synergies, uniforming processes and encouraging efficiency.

Sales (including intersegment sales) and EBITANR figures for the individual operating divisions for 2012 are shown in the table below.

The trend in all geographic areas is cautious: Italy, which accounts for 8.4% of revenues, experienced a 14.4% drop in sales, while sales in Europe increased by around 3%. North America increased by 29% mainly due to the acquisitions in the Industrial Automation Division, while Asia Pacific increased by 3% compared with 2011.

Events for the year

In January 2012 the new ADC Division became operational as a result of the restructuring which took place within the Group last year which led to a focus on the two target markets “Industrial Automation” (IA) and “Automatic Data Capture” (ADC), which includes Datalogic Scanning, Datalogic Mobile, Enterprise Business Solutions and the company Evolution Robotics Retail.

The acquisition of the company Accu-Sort Systems and its subsidiaries was completed on 20 January 2012. Accu-Sort Systems, based in Telford, Pennsylvania, boasts around 80 patents, 57 of which are registered in the United States, 250 employees, one production site, two research centres – one in Europe and one in the USA – and 8 commercial offices.

On 1 July 2012, the integration of Datalogic Automation, Accu-Sort Systems and PPT Vision into a single entity was completed, which will strengthen the Group’s global position in the industrial automation market.

In September the update of the 2012-2014 Business Plan was presented.

Subsequent events after the reporting date

On 15 February an extraordinary meeting of the Board of Directors of the Group was held during which the CEO, Mauro Sacchetto, resigned. The Board of Directors assigned his management powers to the Chairman and founder of the Group, Romano Volta.

Outlook for the current year

The macroeconomic context envisages demand which remains uncertain, in line with what was already registered in 2012, with a steady improvement over the course of the year until the second half of 2013, which sees a return to growth, albeit slight. The cyclical upturn would be possible due to the gradual recovery of investments following the normalisation of lending conditions, the recovery in demand in the Euro area, which accounts for more than 40% of Group sales, and the partial improvement of confidence.

To contrast the uncertain trend in market demand and improve its competitive position, Datalogic has chosen to continue to implement the Group’s strategic plan. The 2012-2014 Business Plan presented in September 2012, is an extension of the previous 2011-2013 Business Plan approved in June 2011 and was supplemented by the acquisitions of PPT Vision and Accu-Sort Systems. The strategic drivers for growth are customer orientation, international expansion, investment in technology and innovation, the development of excellent products and efficiency in operating processes.

It is predicted that, despite the not so good conditions of market demand, the two main operating divisions, ADC and Industrial Automation, can grow from 2012 by focusing on the efficiency of the new offer and market orientation models, on the continually expanding range of highly innovative products and on the quality and motivation of its human resources.

***

At the shareholders’ meeting scheduled for 23 April 2013, the Board of Directors will propose the payout of an ordinary dividend, gross of legal withholdings, of 15 eurocents per share (unchanged from 2011) for a maximum amount of €8.8 million (ex-date of 13 May, record date of 15 May) and payment date from 16 May 2012.

The Board of Directors also approved the Annual Corporate Governance Report. A copy of the report will be made available to the public in accordance with applicable law.

Note that the auditing of the draft financial statements has not yet been completed and that the independent auditors’ report will be made available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Finally, the Annual Financial Report (pursuant to article 154-ter of the Testo Unico della Finanza - TUF) of Datalogic S.p.A. will be made available to anyone who requests it at the company headquarters or at Borsa Italiana SpA, and may also be consulted on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations.

The manager responsible for preparing the company’s financial reports - Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st December 2012 – Euro/1.000

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

[1] EBITDA - Earnings before interest, taxes, depreciation and amortization

Reclassified Balance Sheet at 31st December 2012 – Euro/1.000

Net Financial Position at 31st December 2012 – Euro/1.000

|