|

• Sales revenues at 464.5 million Euro, +3.1% compared to 450.7 million Euro of the previous year

• EBITDA at 69.4 million Euro, +15.8% compared to 60.0 million Euro in 2013, EBITDA Margin up from 13.3% to 14.9%

• Net profit at 30.9 million Euro, +14.7% compared to 26.9 million Euro of the previous year

• Strong decrease of the consolidated net financial debt at 55.7 million Euro compared to 97.0 million Euro at 31st December 2013 thanks to the continuous cash generation

• Proposed a dividend of 18 eurocents per share with a growth of +12.5% compared to the previous year

Bologna, 6th March 2015 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the draft financial statements for the parent company and the consolidated financial statements at 31st December 2014.

The 2014 results highlight a general recovery of the ADC Division in all the reference markets thanks to the introduction of new technologically advanced products that have stimulated a return to investment by retailers and a continuing reflective trend of the IA Division, especially in the North American market, but showing clear signs of a recovery in the latter part of the year. 2014 closed with sales revenues rising by 3.1% to 464.5 million Euro, a strong improvement in marginality, with EBITDA growing by 15.8% to 69.4 million Euro (with a 14.9% EBITDA margin) and net profit increasing by 14.7% to 30.9 million Euro.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: "We are particularly satisfied with the trend shown by the results achieved in 2014, which demonstrate the effectiveness of the strategic choices that were adopted, choices aimed at achieving Group growth and in particular at expanding our presence in emerging geographic areas which have a higher growth rate and at maintaining a leadership role in Europe and the USA. The continuous investments made during the year both in production and on the sales organization front have made it possible to merge a positive trend in revenues with excellent growth in marginality. The considerable increase in Research and Development investments, which must be underlined, is necessary to guarantee the continuous innovation of product and technology. Looking at 2015, which we expect to be a year of growth and development, the target continues to be the satisfaction of our customers and partners, with an efficient management of costs".

It should be noted that 2013 data was reclassified in order to conform with 2014 data.

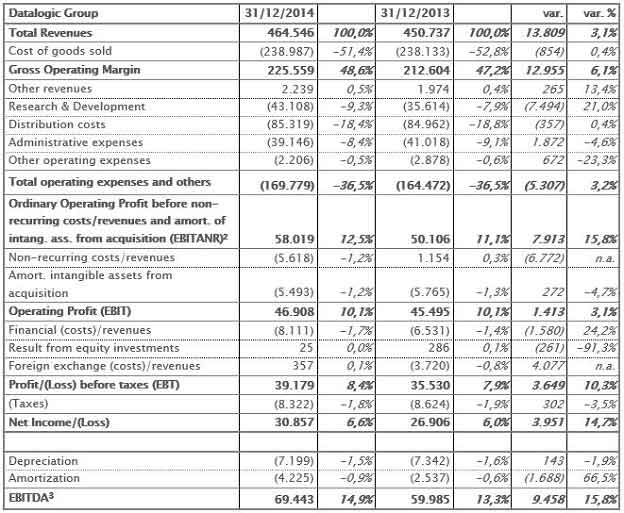

Sales revenues in 2014 came in at 464.5 million Euro, with a growth of +3.1% compared to 450.7 million Euro of the previous year. At constant Euro/Dollar exchange rate there is no sign of significant change in revenue.

Gross operating margin came in at 225.6 million Euro, +6.1% compared to 212.6 million Euro of the previous year, thanks mainly to a reduction in the cost of components, and its incidence on revenue, which was 48.6%, that was more than one percentage point higher with respect to 47.2% in 2013.

Operational costs worth 169.8 million Euro, increased by 3.2% with respect to 164.5 million Euro in 2013 but maintain the same proportion of 36.5% in relation to the revenue. It is important to highlight the higher Research and Development costs which have grown both in absolute value, from 35.6 million Euro to 43.1 million Euro, and in terms of incidence on revenues (from 7.9% to 9.3%), as a result of the increasing importance that the Group attributes to development and innovation, and the continuous monitoring of General and Administration expenses that felt by 4.6% to 39.1million Euro.

EBITDA increased by 15.8% to 69.4 million Euro, with an EBITDA margin at 14.9% compared to 13.3% of the previous year.

EBITANR came in at 58.0 million Euro up by 15.8% compared to 50.1 million Euro in 2013.

The Operating Result went from 45.5 million Euro to 46.9 million Euro, highlighting a growth of 3.1%. Non-recurring costs worth 5.6 million Euro with respect to non-recurring revenue of 1.1 million Euro in 2013 had an impact on the Operating Result. This was mainly attributable to Group reorganization and the disposal of a line of products of the Informatics Division that was no longer strategic.

Financial costs totalled 8.1 million Euro compared to 6.5 million Euro in 2013, while foreign exchange revenues came to 0.3 million Euro compared to foreign exchange costs equal to 3.7 million Euro of the previous year.

Group net profit came in at 30.9 million Euro, with a growth of +14.9% compared to 26.9 million Euro in the previous year.

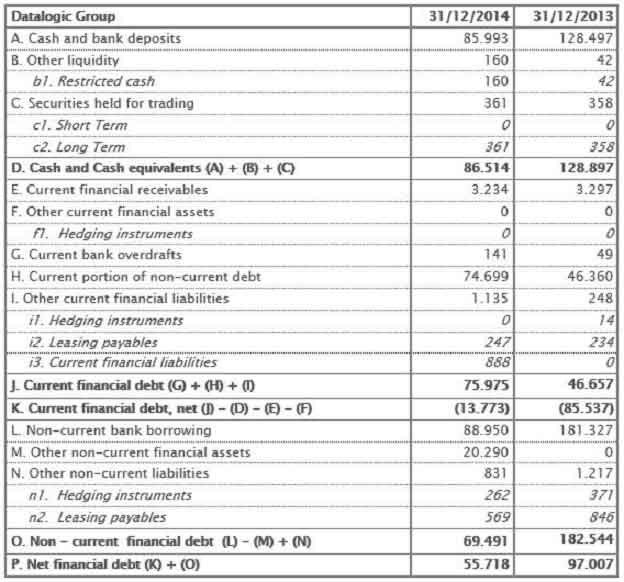

As of 31st December 2014, net financial debt improved significantly, declining to 55.7 million Euro with respect to 97.0 million Euro as of 31st December 2013, thanks to the continuous and robust generation of cash.

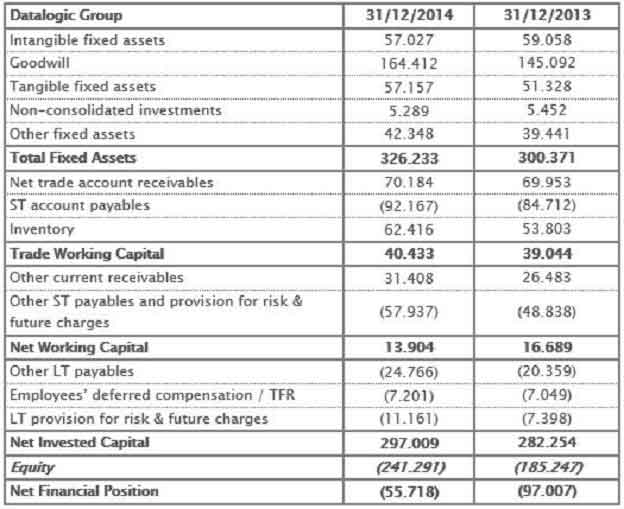

As at 31st December 2014, net working capital decreased to 13.9 million Euro compared to 16.7 million Euro at 31st December 2013.

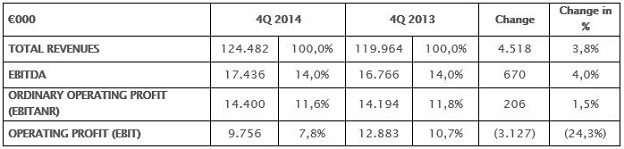

4Q 2014 TREND

There were clear signs of recovery in the fourth quarter of 2014 as compared with the previous quarter, with revenue climbing to 124.5 million Euro (+7.3% with respect to the third quarter 2014 and +3.8% with respect to the fourth quarter 2013). EBIT reflects the effect of the non-recurring costs booked in the last quarter of the financial year.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring – Risultato operativo ordinario prima dei costi e ricavi non ricorrenti e degli ammortamenti derivanti da acquisizioni

Comparison between fourth quarter 2014 and fourth quarter 2013

The booking during the quarter – the orders already received - were equal to 130.4 million Euro.

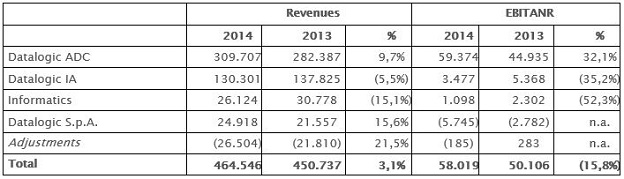

PERFORMANCE BY DIVISION

The ADC Division (Automatic Data Capture), specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, continues to show significant growth thanks to the introduction of new technologically advanced products. Specifically, 2014 was a good year for the fixed scanner market, especially thanks to the Magellan line, with laser and imager technology. The market for hand held readers was also positive thanks to a complete renewal of the product family with the technology for decoding 2D codes (among the main product lines introduced in 2014 the new Quickscan and Powerscan families and the Cobalto CO5300 are worthy of note). The Division registered revenues of 309.7 million Euro, with a growth of 9.7% in 2013, and a very high growth in EBITDA (+31.1% at 66 million Euro with an EBITDA Margin of 21.3%) and EBITANR (+32.1% at 59.3 million Euro).

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, registered revenues of 130.3 million Euro down from 137.8 million Euro registered in 2013, but highlighted a significant trend reversal in the fourth quarter. Such growth is powered by the launch of new products, dedicated primarily to the Factory Automation segment (e.g. the new P-Series smart cameras). The Division, excluding the System Business Unit, which continues to pay the price of cyclic activity of the postal segment, exhibited a positive trend in all regions, mainly in EMEA and in APAC. In particular, 2014 was a positive year for the Identification Business Unit that constitutes approximately 60% of IA revenue, thanks to its efforts to renew its product range launching various products including the new Matrix Imager.

Finally Informatics registered sales of 26.1 million Euro compared to 30.8 million Euro in 2013. In the second quarter of the year, a new General Manager was appointed with a 10-year experience in automatic identification sector and software solutions for retail.

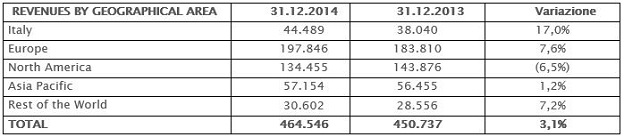

REVENUES BY GEOGRAPHIC AREA

With regard to geographic areas, the European market registered a significant growth (+8% for Europe excluding Italy which registered a 17% increase) in ADC and in IA. North America continued to reflect the downtrend of the postal segment, while the ADC division continued to register a two digit growth thanks to investments in the retail segment.

PERIOD EVENTS

In 2014, the Company continued its development path based on the following strategic priorities:

- Customer Focus

- Increase the market share in those markets that have greater potential for growth

- Development of human resources

Specifically, regarding the actions aimed at increasing market share, the following actions should be noted:

- Opening of a new sales office in Istanbul in April;

- The inauguration in July of a new plant in Brazil, for the assembly of some product lines of the ADC Division;

- The reorganization of the "go to market" model for the Industrial Automation Division in the US market, with the target of improving service in the reference vertical markets.

In the context of the Industrial Automation Division, Valentina Volta was appointed CEO of the Industrial Automation Division following the resignation of Gian Paolo Fedrigo, on 30th June 2014, and on 1st September Alberto Bertomeu, who has over ten years experience in this sector, was appointed new General Manager for the Americas.

On 11th March the placement of 6,295,018 ordinary shares, representing approximately 10.8% of the share capital, addressed exclusively to institutional investors was completed through an Accelerated Bookbuilding procedure.

SUBSEQUENT EVENTS

Starting from 1st January 2015, Sergio Borgheresi was appointed new Group CFO and Investor Relations Manager for Datalogic, following the resignation of Marco Rondelli.

Today, the Board of Directors appointed the Group CFO and Investor Relator Sergio Borgheresi as the manager in charge of the preparation of the company's accounting documents pursuant to the article 154-bis of D.Lgs. n. 58/1998. His appointment has been made with the prior approval of the Board of Statutory Auditors in compliance with professional and good repute requirements laid down by Datalogic by-laws. The Board of Directors has verified that he has adequate powers and resources for the fulfilment of this role.

On 24th February 2015 a medium term debt refinancing was completed with a pool of banks for an overall amount of 140 million Euro with an interest rate that reflects market rates and a five year repayment term with covenants that are substantially in line with the best practice for similar loans taken out by the Datalogic Group. This operation enables Datalogic to further improve its financial structure by lengthening the average repayment term of medium-term debt from the current two to approximately four years and by reducing the average cost of debt.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

A more favourable macro-economic scenario is expected in 2015, especially in Europe where the economy has slowed down substantially in recent years. In the United States, the growth that began in 2014 should continue more forcefully, while the "fast growing" countries that fuelled the growth of the world Economy in recent years could register a slowdown.

In this context in 2015 the Datalogic Group will continue its growth path based on strengthening the Group’s competitiveness in the reference markets – Automatic Data Capture (ADC) and Industrial Automation (IA) – through a greater focus on growth and technological innovation, for which investment will reach 10% of the revenue, in all sectors: Retail, Manufacturing, Transportation & Logistics and Healthcare. The company will continue to focus on customers by leveraging the uniqueness of the Group leadership in both ADC and IA markets. In particular it is expected that the ADC division will continue to benefit from the introduction of new products and technology mainly in the retail sector, and that IA will start to reap the benefits of the reorganization process that was started in 2014 and that has seen the strengthening and restructuring of the sales organization by sector. Development in emerging countries will continue with higher growth by strengthening direct presence and sales organizations. In particular, concentrating the procurement function in China will enable the company to benefit from the reduced cost of components and to strengthen its presence there.

***

At the Shareholders’ meeting scheduled for 28th April 2015, the Board of Directors will propose the payout of an ordinary dividend, gross of legal withholdings, of 18 eurocents per share (with a growth of +12.5% compared to 16 eurocents per share for 2013) for a maximum amount of 10.5 million Euro, with coupon detachment on 11th May 2015 (record date 13th May) and payment date from 14th May 2015.

The Board of Directors also approved the Annual Corporate Governance Report. A copy of the report will be made available to the public in accordance with applicable law.

Note that the auditing of the draft financial statements has not yet been completed and that the independent auditors’ report will be made available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Finally, the Annual Financial Report (pursuant to article 154-ter of the Testo Unico della Finanza - TUF) of Datalogic S.p.A. will be made available to anyone who requests it at the company headquarters or at Borsa Italiana SpA, and may also be consulted on the company’s website www.datalogic.com (Investor Relations section), in accordance with the law and applicable regulations.

The manager responsible for preparing the company’s financial reports - Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 31st December 2014 – Euro/1.000

Note: In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[2] EBITANR – Earnings before interest, taxes, acquisition and non recurring .

[3] EBITDA - Earnings before interest, taxes, depreciation and amortization.

Reclassified Balance Sheet at 31st December 2014 – Euro/1.000

Net Financial Position at 31st December 2014 – Euro/1.000

|