Press Releases

Press Releases

DATALOGIC (Star: DAL.MI) - Record results in second quarter of 2011

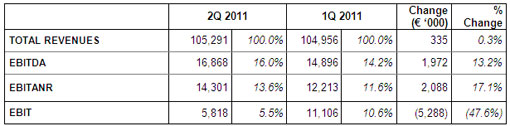

• Record result of quarterly margin: EBITDA rose from € 14.9 million in first quarter of 2011 to € 16.9 million in second quarter of 2011, with EBITDA margin improving from 14.2% to 16%.

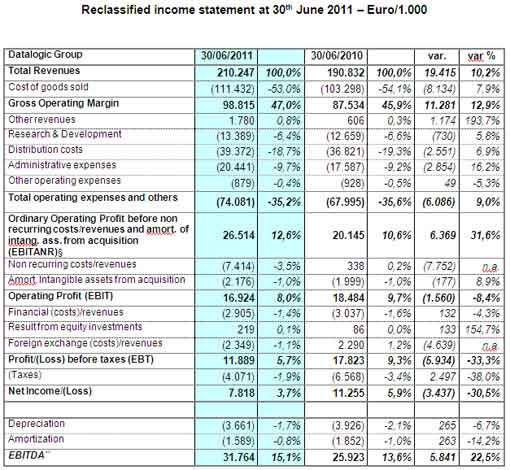

• On a half-yearly basis sales revenues grew by 10.2% to € 210.2 million vs. € 190.8 million reported in the first half of 2010.

• EBITDA rose by 22.5% to € 31.8 million, vs. € 25.9 million in the first half of 2010, and half-year EBITDA margin increased to 15.1% vs. 13.6% in the same period last year.

• Group net profit amounted to € 7.8 million vs. € 11.2 million in the first half of 2010.

• € 8.5 million of extraordinary costs were expensed for the new supply chain of the ADC segment; EBITDA before extraordinary costs would have been about € 32.9 million (+26.6% vs. first half of 2010) while net profit would have been about € 14 million (+22.6% vs. first half of 2010).

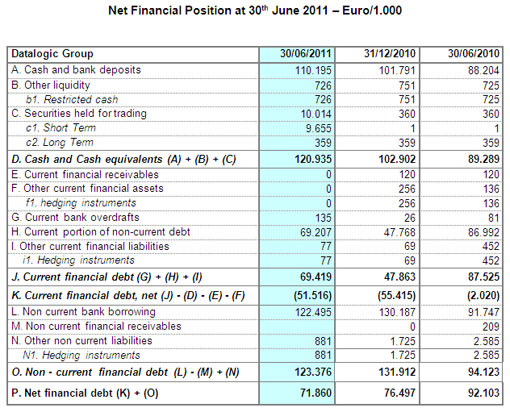

• Consolidated net debt improved to € -71.9 million compared to € -76.5 million at 31st December 2010.

Bologna, 29th July 2011 – Today the Board of Directors of Datalogic S.p.A. (Borsa Italiana: DAL), a company listed in the Star segment of Italy’s stock exchange (MTA) organised and managed by Borsa Italiana SpA (“Datalogic”) and market leader in barcode readers, mobile computers, RFID and vision systems, approved the half-year report at 30 June 2011.

The best ever results for the period confirmed Datalogic’s growth trend in terms of market share. The project for the new integrated supply chain in the ADC (Automatic Data Capture) segment was launched.

The first half (1H11) ended with a net profit of € 7.8 million vs. € 11.2 million reported in the first half of 2010 (1H10). It was driven by a favorable trend both of sales revenues and margins, which made it possible to expense € 8.5 million of extraordinary costs relating to implementation of the integrated supply chain.

Mauro Sacchetto, CEO of Datalogic S.p.A., commented: “The extremely positive first-half results confirm the singular features of Datalogic – a company capable of continuing to grow and generate profit even in a still uncertain market environment. The strategic actions taken in previous quarters, in terms of control of overhead costs and focus on efficiency, allow continuous improvements in terms of margin, as confirmed by an EBITDA margin that hit 16% in the second quarter. These improvements will be even more incisive, significant recouping of profitability as from the next financial year, with adoption of the new integrated supply chain for the ADC, for which over 80% of the investment has already been expensed during the first half. Lastly, our continuous investments in R&D enable us to maintain constant ability to innovate and to assert our technological superiority, assuring us global leadership of the sectors in which we operate”.

Consolidated sales revenue in 1H11 amounted to € 210.2 million with a 10.2% increase over € 190.8 million in 1H10. At constant EUR/USD exchange rates, the increase would have been about 13%.

Group EBITDA grew from € 25.9 million in 1H10 to € 31.8 million. EBITDA margin rose to 15.1% vs. 13.6% in 1H10, positioning itself at higher levels than those achieved by the Group before the start of the crisis.

Research and development costs grew by 5.8% to € 13.4 million (6.4% of sales) vs. € 12.7 million in 1H10 (6.6% of sales).

During 1H11 extraordinary costs of € 8.5 million were posted, of which € 1.1 million recorded in administrative expenses and € 7.4 million posted in non-recurring costs, concerning adoption of the new supply chain, which had integrated all the Operations processes (production and logistics) of the Datalogic Scanning and Datalogic Mobile divisions in the ADC segment.

This new Operations architecture at international level will ensure greater industrial productivity and will make it possible to take all growth opportunities, expanding the factory in Vietnam, a country developing strongly and a strategic point of the entire Asian area where the market is growing at extremely fast rates.

After financial charges substantially stable at € 2.9 million vs. € 3.0 million in 1H10 and foreign exchange losses of € 2.3 million compared to foreign exchange profit of € 2.3 million in 1H10, Group net profit amounted to € 7.8 million vs. € 11.2 million achieved in 1H10. Before the extraordinary costs relating to the project for the new supply chain, Group net profit would have been about € 14 million, with 22.6% growth over 1H10, while EBITDA would have been approximately € 32.9 million (+26.6% vs. 1H10).

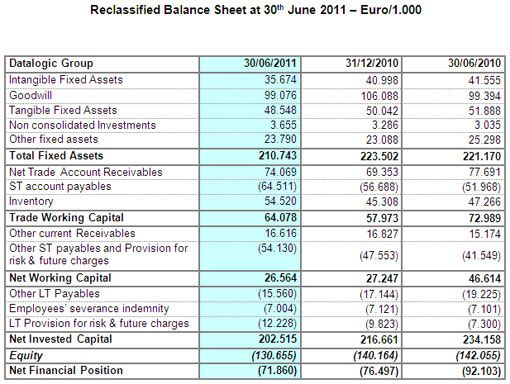

The net financial position at 30th June 2011 showed further improvement after the progress made in previous quarters and showed net debt of € 71.9 million vs. € 76.5 million at 31st December 2010. Net working capital amounted to € 26.6 million at 30th June 2011, decreasing vs. € 27.2 milllion at 31st December 2010. It is pointed out that, during 1H11, dividends of some € 8 million were paid.

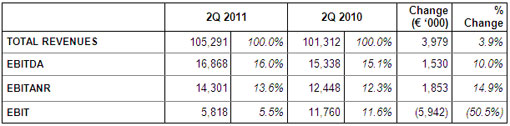

At a quarterly level, the results of the second quarter of 2011 (2Q11) showed progress vs. the second quarter of 2010 (2Q10) and also vs. the first quarter of 2011 (1Q11), mainly in terms of margin improvement. More specifically, sales revenues held steady at € 105.3 million (+3.9% vs. 2Q10 and substantially in line with 1Q11); EBITDA amounted to € 16.9 million (vs. € 15.3 million in 2Q10 and +13.2% vs. 1Q11) and EBITANR [1] to € 14.3 million (vs. 12.4 million in 2Q10 and +17.1% vs. 1Q11).

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring.

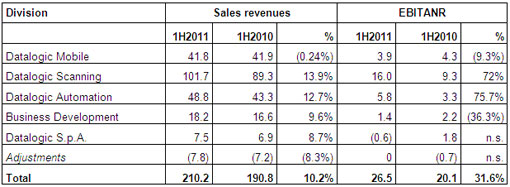

All Group divisions recorded a substantially positive trend.

In the Automatic Data Capture (ADC) segment, the Datalogic Scanning Division – specialized in the production of bar code readers for the retail market and hand held scanners and accounting for 48% of consolidated sales - grew by 14% in terms of sales revenue and by 58% in terms of EBITDA, € 18 million. The Datalogic Mobile Division - specialized in the production of mobile computers for professional use and accounting for 20% of consolidated sales – featured performance substantially in line with 1H10 in terms both of sales revenue and EBITDA, € 5 million.

Datalogic Automation – specialized in the production of barcode, RFID and vision automatic identification systems and accounting for 23% of consolidated sales – featured an increase of 13% in sales revenue and of 46% in terms of EBITDA, € 7.2 million.

The Business Development Division - which includes the companies Informatics Inc. and Evolution Robotics Retail Inc. and accounts for 9% of consolidated sales – achieved a 10% increase of sales revenue to € 18.2 million.

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) by segment for 1H11.

As regards geographical areas, we highlight the good progress of sales in the markets of North America, up by 15% to € 62 million, and Europe, which grew by 12% to € 84 million. Italy showed improvement of 8% to € 24 million, where growth in emerging countries slowed down after the major increases experienced during 2010.

Events in the reporting period (1H11)January marked the start of the Group’s divisions by market: Automatic Data Capture (ADC), which includes the Mobile and Scanning Divisions and Industrial Automation (IA) which includes the Automation Division.

On 29th June 2011, the new 2011-2013 Business Plan was presented. For 2013 the Plan envisages the following objectives:

• Expected revenues between € 470-480 million, 2009-2013 CAGR above 11%

• Expected EBITDA between € 80-85 million, 2009-2013 CAGR of around 45%, EBITDA margin between 17%-18%

• Expected ROE between 23%-24%

• Sharp improvement in net financial position (1[1]), expected to be positive at between €15 and €20 million

Events after end of reporting period (1H11)

There are no events to report.

****

The auditing activity for the half-year interim report has not yet been completed and the audit report will be available within the deadlines set at law. The attached balance sheet and income statement are reclassified statements, and as such have not been subject to audit.

Lastly, please note that the half-year interim report at 30th June 2011 will be available upon request at the registered office of Datalogic S.p.A. and at the offices of Borsa Italiana S.p.A., and it could also be consulted on the Company’s web site www.datalogic.com (Investor Relations section).

The manager responsible for preparing the company’s financial reports - Dott. Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

(1) NFP calculated gross of expected dividends.

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring.

[1] EBITDA - Earnings before interest, taxes, depreciation and amortization.