|

Highly positive results achieved in first nine months of 2010:

• Sales revenues grew by 29.4% to € 291.2 million vs. € 225.1 million reported in the first nine months of 2009

• EBITDA rose to € 38.8 million (+257%) vs. € 10.9 million in the first nine months of 2009, with an EBITDA margin rising to 13.3%

• Net profit surged to € 14.5 million as opposed to a loss of € -13.9 million reported in the first nine months of 2009

• The negative consolidated net financial position improved to € -93.2 million vs. € -100.5 million at 31 December 2009

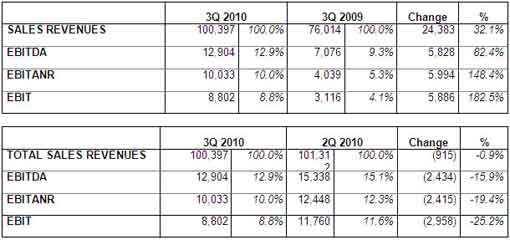

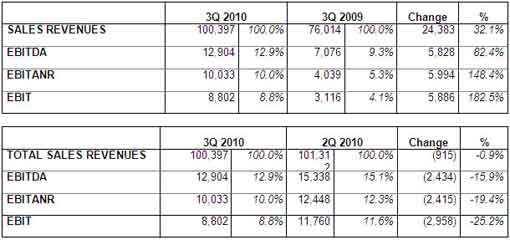

Third-quarter results confirming effectiveness of strategic choices implemented:

• Sales revenues showed growth of 32.1% to € 100.4 million vs. € 76 million in the third quarter of 2009

• EBITDA rose to € 12.9 million (+82%) from € 7.1 million in the third quarter of 2009

• Net profit amounted to € 3.2 million (+446%) vs. € 0.6 million in the third quarter of 2009

• Operating cash flow generated in the quarter (excluding Evolution Robotics Retail acquisition) amounted to € 20.8 million

Bologna, 4 November 2010 – Today the Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL) - a company listed in the Star segment of the Milan Stock Exchange (Mercato Telematico Azionario - MTA) organized and managed by Borsa Italiana S.p.A. (“Datalogic”) and leader in the market for barcode readers, data collection mobile computers, RFID and vision systems - approved the Interim Management Statement at 30 September 2010.

The period’s results confirm the growth trend and the soundness of the strategic choices applied.

The first nine months of the year (9M10) ended with a net profit of € 14.5 million as opposed to a net loss of € -13.9 million reported in the first nine months of 2009 (9M09). The third quarter (3Q10) featured sales revenues of € 100.4 million (+32.1% vs. the third quarter of 2009 (3Q09)) and net profit of € 3.2 million (€ 0.6 million in 3Q09).

Mauro Sacchetto, the CEO of Datalogic S.p.A., commented on results as follows: “We’re very satisfied with the more than positive performance of this third quarter – a period statistically featuring a so-called seasonality effect that has an impact on results in terms of efficiency and cash generation.

The results are even more encouraging if one considers that, in July, Datalogic completed the acquisition of Evolution Robotics Retail, a leading company in the sector of solutions based on the innovative technology of visual pattern recognition – a deal financed entirely by internal resources and whose ancillary costs were totally expensed in the quarter.

Even although the international economic environment continues to be uncertain, this quarter further confirms the effectiveness of the actions taken and of the choices made. It enables us to look ahead with increasing confidence and enthusiasm to the challenges of the near future and to continue along the path initiated”

Consolidated sales revenues in 9M10 totalled € 291.2 million, increasing by 29.4% over € 225.1 million in 9M09. At constant EUR/USD exchange rates the YoY increase would have been about 2.8 percent points lower (26.6%).

Group EBITDA surged from € 10.9 million in 9M09 to € 38.8 million while EBITDA margin rose to 13.3% vs. 4.8% in 9M09, establishing itself at levels higher than those achieved by the Group before the start of the crisis.

EBITANR amounted to € 30.2 million vs. € 0.6 million in 2009.

After financial charges substantially stable at € 4.5 million vs. € 4.7 million in 9M09 and foreign exchange losses of € -0.9 million, Group net profit grew to € 14.5 million as opposed to the net loss of € -13.9 million made in 9M09.

The net financial position at 30 September 2010 showed net debt of € -93.2 million, with improvement vs. € -100.5 million at 31 December 2009 notwithstanding the acquisition of Evolution Robotics Retail, completed on 1 July 2010, which involved a cash outlay of € 20.9 million. Net working capital at 30 September 2010 amounted to € 38.6 million, decreasing by € 4.6 million vs. € 43.2 million as at 31 December 2009.

As regards the quarter, sales revenues confirmed a level of € 100.4 million (+32.1% vs. 3Q10 and substantially in line with the previous quarter (2Q10) thanks to commercial strategy and to continuous product innovation and notwithstanding the seasonal effect that typically penalizes this period of the year. Operating costs of € 36.4 million (increasing by 28.5% over 3Q09 and by 4.3% over 2Q10) reflected higher variable costs stemming from sales growth (mainly consisting of commercial and marketing expenses, bonuses and commissions) and non-recurring costs of € 483 thousand relating to the acquisition of Evolution Robotics Retail. EBITDA thus rose to € 12.9 million (+82.4% vs. 3Q09) and EBITANR to € 10.0 million (vs. € 4.0 million in 3Q09).

A point to note in the quarter is strong cash generation, totalling € 20.8 million, thanks to the good trend of operating profitability and to the reduction of so-called trade working capital to € 6.6 million.

EBITANR – Earnings before interest, taxes, acquisition amortization and non-recurring items.

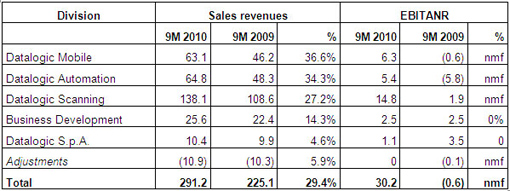

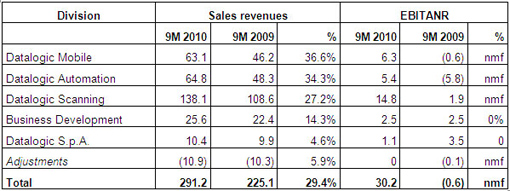

As regards the Group’s operating divisions, all of them reported results featuring very robust growth in 9M10 in terms both of sales revenues and of profitability.

As regards sales revenues, the Datalogic Mobile Division – specialized in the production of mobile computers and accounting for 22% of consolidated sales – continued to show very buoyant growth, i.e. +36.5%.

Datalogic Automation – specialized in the production of barcode, RFID and vision automatic identification systems and accounting for 22% of consolidated sales – achieved an increased of +34.4%, while the Datalogic Scanning Division – specialized in the production of bar code readers for the retail market and hand held scanners and accounting for 47% of consolidated sales – grew by +27.2%. The Business Development Division (including Informatics Inc. and the recently acquired company Evolution Robotics Retail Inc.), accounting for 9% of consolidated sales, achieved an increase of +14.3% to € 25.6 million.

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) by segment in 9M10.

As regards geographical areas, particularly significant growth continued of sales targeting emerging markets in Asia and South America, with a respective increase of +59% (from € 22.9 million to € 36.4 million) and +88% (from € 18.7 million to € 35 million) in 9M10 vs. 9M09 – mainly thanks to the Automation Division in Asia and to the Mobile Division in South America. North America grew by +18%, rising from € 69.8 million to € 82.8 million, while Europe grew by +24%, rising from € 85.8 million to € 106.2 million.

Events in the quarter

On 1 July 2010 acquisition was completed of Evolution Robotics Retail Inc., a company based in the State of California (USA), possessing unique expertise in visual pattern recognition technology for retail applications designed to prevent thefts and losses and consequently increase productivity. The value of the deal was USD 25.5 million Evolution Robotics Retail is debt-free and Datalogic used its own resources to finance the acquisition. Evolution Robotics Retail is the holder of five patents and of eleven patent applications filed at the United States Patent and Trademark Office.

Events after quarter-end

On 4 October the Board of Directors approved the 2010-2012 Business Plan, for which the main 2012 objectives are:

• Expected sales revenues in the € 420-430 million range, 2009-2012 CAGR = 11%

• Expected EBITDA in the € 60-65 million range, 2009-2012 CAGR exceeding 45%, EBITDA margin between 14% and 15%

• Expected ROE in the 18-20% range

• Strong improvement in the expected Net Financial Position(1) between € -25 and € -35 million.

The Board of Directors today also approved the following:

1. certain Company By-Laws amendments (within the scope of the Board’s powers at law and under such By-Laws) for the purposes of full compliance with the new statutory provisions introduced by Italian Legislative Decree n. 27/2010 (Italian implementation of EC Directive 2007/36/EC on the exercise of certain rights of shareholders in listed companies); the text of the amended By-Laws will be published in accordance with applicable legal and regulatory requirements in force;

2. adoption of a new code which ensures transparency and substantive and procedural regulatory compliance for related party transactions pursuant to the new provisions for such transactions enacted by the Italian Securities Authority (CONSOB) under resolutions 17221/10 and 17389/10; the full text of the code will be published on the Company’s website without delay.

Please note that the Interim Management Statement at 30 September 2010 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports - Dott. Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

|