|

• Datalogic in 2014:

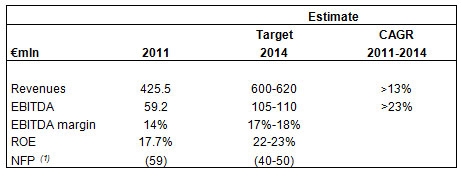

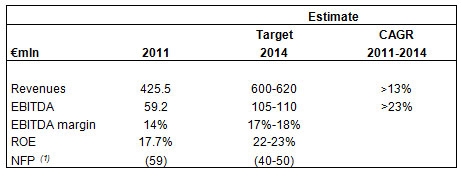

- Revenues forecast between €600-620 million, 2011-2014 CAGR over 13%

- EBITDA forecast between €105-110 million, 2011-2014 CAGR over 23%, EBITDA Margin at 17%-18%

- ROE forecast at 22%-23%

- Strong improvement in net financial debt (1) forecast between €40-50 million, thanks to strong cash generation

• Growth drivers confirmed with the strengthening of the Group’s leadership in Automatic Data Capture (ADC) and Industrial Automation (IA) markets

• Constant product innovation with annual R&D investment at 7% of revenues

Bologna, 27th September 2012 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed on the Star segment of Italy’s electronic stock market (MTA) organised and managed by Borsa Italiana SpA (“Datalogic”), a global leader in Automatic Identification and total solutions provider of bar code readers, data collection mobile computers and vision systems, today approved the Group’s 2012-2014 Business Plan.

The 2012-2014 Business Plan is a rolling plan that confirms the growth drivers of the plan approved in June 2011 and extends the time horizon to 2014. The Plan is based on strengthening the Group’s competitiveness on its reference markets – Automatic Data Capture (ADC) and Industrial Automation (IA) – as well as growth in emerging countries and an ongoing improvement in industrial efficiency and productivity. It takes into account the change in the economic environment, for which the main independent research companies within the sector forecast a slowdown in market growth in 2012 and a recovery from next year.

The main operating and financial targets for 2014 are summarised in the table below:

Mauro Sacchetto, CEO of Datalogic Group, commented: “Datalogic has approved its third consecutive business plan, setting higher growth targets for the next two years, both in terms of revenues and margins, a clear indication that it is a leading company able to look confidently to the future. Datalogic is today a different group to what it was in the past, with a business allocated according to reference market rather than product, with a new global supply chain that has integrated all operation processes, and with new operating structures. What has remained unchanged is Datalogic’s desire to innovate and grow in markets all over the world at a faster pace than its main competitors, maximising the efficiency of all its internal processes”.

Strategic drivers

The 2012-2014 Business Plan is an extension of the previous 2011-2013 Plan, approved in June of last year, but the two cannot be compared, since the new plan takes into account the integration of PPT Vision, acquired at the end of December 2011, and of Accu-Sort Systems, the US leader in Industrial Automation acquired in January 2012. The two companies were consolidated from 1 January and, from 1 July 2012, are completely integrated within Datalogic Automation.

The Plan confirms the Group’s strategic value-creation drivers:

• Strengthening of strategic positioning

• International expansion

• Product and process innovation

• Efficiency and productivity

The extension of the plan to 2014 takes into account the changed economic environment, and provides for growth in the Automatic Data Capture (ADC) market, including the POS Retail segments (barcode readers for the retail market), Hand Held Scanners and Mobile Computers, estimated globally at a 2010-2014 CAGR of 5.7% (versus a 2010-2013 CAGR of 8%), and expected growth for the more fragmented Industrial Automation (IA) market of 5.4% , which compares with a previous 2010-2013 CAGR of 8%. This growth rate is the combined result of a muted 2012 performance as a result of the global macroeconomic crisis and a more sustained recovery in the last two years of the plan.

The Plan intends to direct and focus growth strategy on its two reference markets, Automatic Data Capture (ADC) and Industrial Automation (IA).

The objective in the ADC sector is to grow at a faster pace than the market (2011-2014 CAGR of approximately 12% versus the market's 5.7%), leveraging on the optimised offer of products and technological solutions, and the strengthened distribution structure resulting from the integration of Datalogic Scanning and Datalogic Mobile into the new Datalogic ADC division, operational since January 2012, and which represents a unique integrated point of reference at global level for advanced solutions in the automatic data capture market.

The improvements expected in the management of customer services, quality and efficiency will enable the Group to increase its presence in the North American market, and develop its business in high-growth markets such as China, South-East Asia, Latin America and Eastern Europe. Investment will also be focused on sectors with higher potential, such as pharmaceuticals and healthcare.

In the highly-fragmented Industrial Automation (IA) market, which has great growth potential in sectors currently not covered by Group products, Datalogic plans to grow at a faster pace than the market, 2011-2014 CAGR +28% compared with +5.4% for the available market (approximately +7% like-for-like versus +5.3% for the market excluding the postal sector), leveraging on the complete integration of the acquired companies into Datalogic Automation and on the new organisation by market, Factory Automation (FA) and Transportation and Logistics (T&L).

Datalogic Automation will also be able to attack the promising machine vision technology sector, following the acquisition of PPT Vision, which already offers some significant synergies within the Factory Automation (FA) sector.

As regards international expansion, the Datalogic Industrial Automation division intends to grow in mature areas such as North America and Europe, thanks to the expertise acquired in solutions positioned at the upper end of the range in the T&L sector, with growth expected to be particularly strong in Turkey, South America and Asia – mainly in China and South Korea.

Datalogic will continue with the constant product and process innovation that has made it the recognised global leader in its reference sectors. Annual R&D investment will be more than 7% of revenues, and will be focused in particular on new Imaging and Vision technologies. Moreover, the strategic activities of Research and Development have been incorporated into the new company Datalogic IP Tech Srl, which will also manage the Group’s patent portfolio, a valuable strategic asset necessary for the Group to maintain a leading role on the market.

Datalogic will continue to invest in the development of self-checkout technologies to optimise front-end functions in the retail market and extend the range of mobile computers, for which the Group will in particular design new platforms for the promising Asian markets.

Within Industrial Automation, Datalogic will continue to invest in the development of imaging solutions, machine vision technology and miniaturised technology for sensors.

Investments to improve efficiency and increase productivity will also continue. The adoption of the new Supply Chain, which integrated all operations processes (production and logistics) of the ADC division in 2011 has begun to bear fruit this year.

This new operations architecture at international level allows a higher level of industrial productivity, and will enable the Group to seize all growth opportunities, upgrading the plant in Vietnam, which now employs around 600 people, in a country undergoing significant development and one that represents a strategic point for the whole Asia region, where the market is registering extremely rapid growth.

Based on these lines of development, the Datalogic Group forecasts that in 2014, it will register consolidated revenues of between €600 million and €620 million, with a 2011-2014 CAGR of 13% (approximately 7% like-for-like).

Thanks to the benefits resulting from the adoption of the new integrated Supply Chain of the Datalogic ADC division in terms of improved efficiency and productivity, and the synergies resulting from the integration of the companies acquired into Datalogic Automation in 2014, the Group expects to achieve an EBITDA figure of €105-110 million, with a 2011-2014 CAGR of approximately 23% (higher than the like-for-like figure of 13%) and with a margin of between 17% and 18%, compared with 14% in 2011.

Thanks to cash flow generation of €110-120 million, net financial debt is seen improving to between €40 and €50 million, with a net debt/EBITDA ratio of less than 0.5X in 2014. In terms of Capex, investments will continue at an ordinary rate of 2% annually.

The measures outlined in the Business Plan will enable the Group to achieve high levels of profitability and value generation, with double-digit growth expected in ROE, which is forecasted to come in at around 22-23% at the end of the period.

As regards its performance in 2012, Datalogic will continue to grow at a faster pace than the market, which is currently registering a lacklustre performance (in 1H12, the Group’s main competitors registered average growth of +0.6% y/y) and despite the delay in some important projects mainly relating to Accu-Sort’s core activities, usually undertaken to order. Revenues are forecasted to increase by 12-14% (from €425.5 million in 2011), while EBITDA is expected to increase to 25-30% (compared to €59.2 million in 2011).

***

The 2012-2014 Plan will be presented at 10.15 on Friday 28 September 2012, in the Blue Room of Palazzo Mezzanotte Congress Centre and Services, Piazza degli Affari 6, Milan.

|