Press Releases

Press Releases

Board of Directors approves the Consolidated Interim Report at 30 September 2019

Nine months results:

-

Revenues at € 461.4 million; -1.0% decline year-on-year

-

Gross operating margin at €223.5 million; 48.4% on revenues substantially in line with the previous year

-

EBITDA at €73.3 million; EBITDA margin at 15.9%

-

Net profit at €39.7 million, 8.6% as a percentage of revenues

-

Net debt at €19.5 million

Bologna, 13 November 2019 - The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange organised and managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and process automation markets, has approved today its Consolidated Interim Report at 30 September 2019.

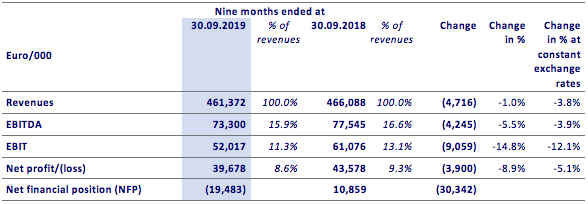

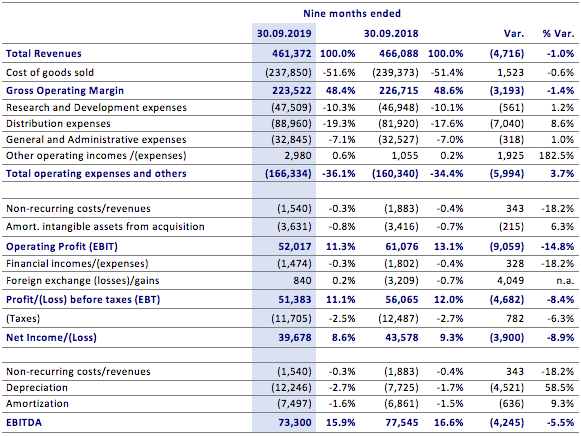

During the first nine months of 2019, revenues come to €461.4 million, showing a slight decline of 1.0% on the same period of 2018. EBITDA decreases by 5.5% to €73.3 million, taking the EBITDA margin to 15.9% (16.6% as at 30 September 2018). Net profit comes to €39.7 million (€43.6 million in the same period of 2018), with an incidence on revenues that goes from 9.3% to 8.6%.

Chief Executive Officer of the Datalogic Group Valentina Volta commented: “Nine months results are in line with expectations despite the uncertainties of the economic environment. The robust growth of revenues in the American markets has partially offset the European and Asiatic turnover downturn, affected by the difficulties recorded in the reference end-markets, in particular consumer electronics in China and the automotive segment. The contribution of new products to the overall turnover, reaching almost 22% (vitality index) in the quarter, proves the effectiveness of the innovation strategy carried on by the Group. Prospectively, we expect to close 2019 in line with the turnover and margins trend recorded during the first nine months, save for any possible deferral of investment decisions by customers.”

Consolidated revenues were €461.4 million, down by 1.0% from €466.1 million in the first nine months of 2018 (-3.8% at constant exchange rates).

Gross operating margin stood at €223.5 million, down by 1.4% from €226.7 million in the same period of the previous year. It remained essentially unchanged as a percentage of turnover in the first nine months of 2019, going from 48.6% in 2018 to 48.4% in 2019. Net of the exchange effect, the gross operating margin improves by 0.6 percentage points to 49.2%.

Operating and other costs of €166.3 million were up by 3.7% on the €160.3 million in the same period of 2018 and increased by 1.7% as a percentage of turnover, from 34.4% to 36.1%. distribution costs increased by 8.6% to €89.0 million, equivalent to 19.3% of turnover, compared with the 17.6% of the same period of 2018, attributable to the investments made to strengthen the commercial organisations. Research and development expenses at €47.5 million (€46.9 million in the first nine months of 2018) with an incidence on turnover of 10.3% vs 10.1% recorded in the same period of last year.

EBITDA decreased by 5.5%, going from €77.5 million in the first nine months of 2018 to €73.3 million, whilst EBITDA margin at 15.9%, 16.6% at constant exchange rates in line with the same period of last year. At constant exchange rates, EBITDA dropped by 3.9% on the first nine months of 2018, reflecting the increase in commercial and research and development investments, partially offset by the effect of the adoption of the new accounting standard IFRS-16 Leases, which resulted in the recognition of higher depreciation of €3.4 million and lower lease expenses of €3.5 million.

EBIT decreased by 14.8% to €52.0 million from €61.1 million, with an incidence on turnover at 11.3% from 13.1% recorded in the first nine months of 2018. Net of the unfavourable foreign exchange effect, EBIT decreased by 12.1%.

Net financial expenses amounted to €0.6 million recording a positive change of €4.4 million on the net expenses of €5.0 million in the same period of 2018, mainly thanks to the favourable performance of foreign exchange differences, which amounted to a gain of €0.8 million (compared with a loss of €3.2 million as at 30 September 2018) and to the rationalisation of treasury footprint.

Net profit amounted to €39.7 million, equal to 8.6% of revenues, down by 8.9% (5.1% net of the exchange effect) in respect with the first nine months of 2018.

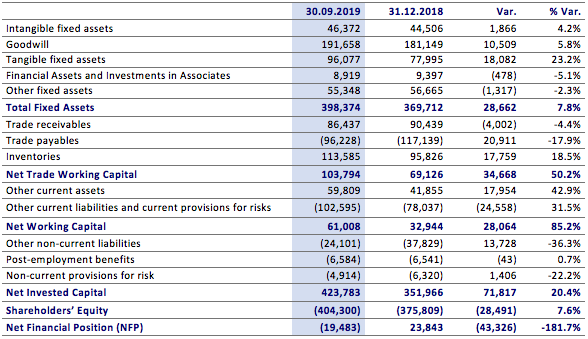

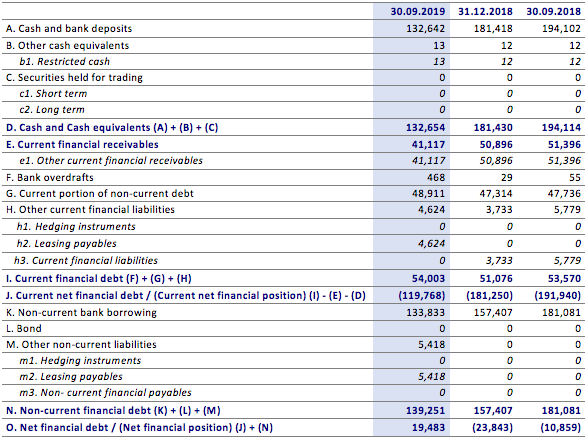

As of 30 September 2019, the Net Financial Position was negative for €19.5 million, with a decrease of respectively €30.3 million on 30 September 2018 (positive for €10.9 million) and €43.3 million on 31 December 2018 (positive for €23.8 million). Net of the application of the new accounting standard IFRS 16, which determined the recognition of right-of-use assets for €9.9 million and financial liabilities for €10.0 million, the net financial position decrease would have been €20.3 million on 30 September 2018 and €33.3 million on 31 December 2018. The change as compared with 30 September 2018 is mainly due to the higher investments for approximately €7.1 million and to working capital trend.

As of 30 September 2019, Net Trade Working Capital was €103.8 million (16.6% of revenues), up by €34.7 million on 31 December 2018. The change is mainly due to the increase in inventories, linked to seasonality, and to the reorganisation of the logistics hub in EMEA, which entailed a greater level of procurement in the cross-over phase, as well as a reduction in trade payables.

PERFORMANCE BY GEOGRAPHIC AREA

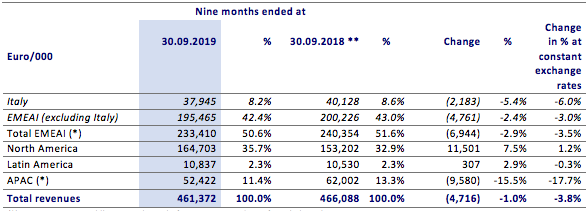

The table below shows Group revenue by geographic area, as achieved in the first nine months of 2019 versus the same period of 2018:

(*) EMEAI: Europe, Middle East, India and Africa; APAC: Asia & Pacific including China

(**) The 2018 comparative data has been consistently restated to reflect the new allocations of revenues.

During the first nine months of 2019 total revenues increased by 7.5% in North America, also thanks to the favourable trend in exchange rates, while decreased by 15.5% in APAC and by 2.9% in EMEAI.

PERFORMANCE BY DIVISION

DATALOGIC DIVISION

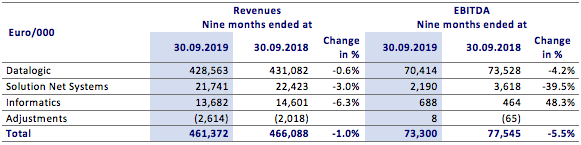

In the first nine months of the year the Datalogic division reported a turnover of €428.6 million, essentially unchanged with respect to the same period of 2018 (-0.6%), with a positive performance in the Americas, partially offsetting the decline in EMEAI and APAC.

Divisional EBITDA amounted to €70.4 million, down by 4.2% on the same period of 2018, with an incidence of 16.4% on turnover (17.1% at 30 September 2018). At constant exchange rates the EBITDA margin is in line with last year (17.2%).

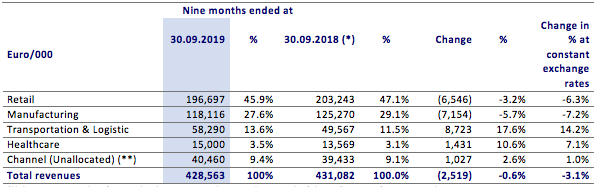

(*) The comparative data for 2018 has been consistently restated as a result of the reallocation of revenues to the various operating segments.

(**) The Channel (Unallocated) segment includes revenues that cannot be directly attributed to the 4 identified segments.

RETAIL

The Retail segment decreases by 3.2% on last year, with a slowdown in EMEA due to the significant roll-outs of the previous two years. Latin America and APAC reported a growth trend, whilst the postponement of certain projects caused a slight downturn in North America.

MANUFACTURING

The Manufacturing segment decreased by 5.7% on the previous year. The slowdown in the automotive market in EMEA and in consumer electronics in China was partially offset by the double-digit growth enjoyed on the North American market.

TRANSPORTATION & LOGISTICS

The Transportation & Logistics segment recorded strong growth of 17.6% on the same period of 2018, driven by a very positive performance in North America and EMEAI.

HEALTHCARE

The Healthcare segment recorded 10.6% growth on the first nine months of 2018, driven by sales in North America and EMEAI.

Distribution channel’s revenues mainly towards small and medium-sized customers in the USA posted a positive performance.

SOLUTION NET SYSTEMS DIVISION

The Solution Net Systems Division recorded revenues for €21.7 million in the first nine months, down by 3.0% on the same period of 2018, mainly due to the seasonality of some projects. Divisional EBITDA was €2.2 million, with an EBITDA margin of 10.1%, compared with 16.1% in the same period of 2018.

INFORMATICS DIVISION

In the first nine months, the Informatics Division recorded revenues for €13.7 million, down by 6.3% on the first nine months of 2018. Divisional EBITDA was positive for €0.7 million (positive for €0.5 million in the same period of 2018).

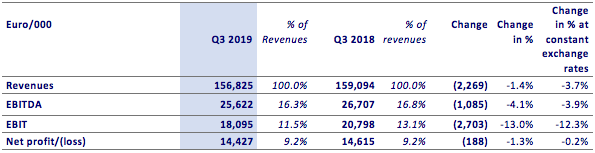

QUARTERLY PERFORMANCE

In the third quarter of 2019, revenues decreased by 1.4% to €156.8 million and EBITDA declined by 4.1% to €25.6 million, reducing the EBITDA margin to 16.3%, compared to 16.8% of the same period of 2018. At constant exchange rates, the EBITDA margin was in line with last year.

Within Datalogic Division, T&L segment posted a 24.6% year-on-year growth (+21.8% at constant exchange rate) as well as Healthcare recorded a 4.7% year-on-year growth (+1.7% at constant exchange rate). Manufacturing recorded its first positive quarter (+1.0% year-on-year, -0.3% at constant exchange rate), despite the continuous negative trend of the reference end-markets. Retail slightly decreased by 2.3% year-on-year (-4.9% at constant exchange rate) due to an unfavorable comparison with the third quarter of 2018, positively affected by relevant roll-outs.

The quarter net profit was €14.4 million, with an incidence on turnover of 9.2% in line with the third quarter of 2018.

SIGNIFICANT EVENTS DURING THE PERIOD

On 1 July 2019 Datalogic S.p.A. appointed Laura Bernardelli as Group Chief Financial Officer.

SUBSEQUENT EVENTS

On 1 October 2019, in implementation of the shareholders' meeting resolution to authorise the purchase and sale of treasury shares, passed on 30 April 2019, Datalogic S.p.A. stipulated an agreement with an intermediary of primary standing, for the buy-back of treasury shares on the market.

OUTLOOK

The positive performance of the Group's business in North America and growth in the turnover of new products confirm that the Group’s strategy is solid. The particularly difficult economic situation in China and the slowdown to the main segments in which the Group operates in Europe, are expected to continue also in the fourth quarter. Despite the uncertainty of the economic environment, the Group will continue to execute its new product development strategy, while keeping costs under control.

In current market conditions, the Group expects to close the year substantially in line with the first nine months, save for any deferral of investment decisions by customers, which may impact the forecasted performance.

***

Finally, the Datalogic S.p.A. interim report on operations at 30 September 2019 is not subject to auditing, and is available in accordance with the law, at the company headquarters at Borsa Italiana S.p.A. (www.borsaitaliana.it), on the “eMarket STORAGE” instrument authorised by Consob and managed by Spafid Connect S.p.A., and may also be consulted on the company’s website www.datalogic.com (Investor Relations section).

***

The manager responsible for preparing the company’s financial reports – Laura Bernardelli – declares, pursuant to paragraph 2 of Art. 154-bis of the Consolidated Finance Act, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

***

This press release contains forward-looking statements about the Group’s intentions, beliefs and current expectations with regard to its financial results and other aspects of the Group's operations and strategies. Readers of the present press release should not place undue reliance on such forward-looking statements, as final results may differ significantly from those contained in the above-mentioned forecasts owing to a number of factors, the majority of which are beyond the Group’s control.

***

Please note that the original version of this press release is in Italian and in case of doubts the Italian version prevails.

RECLASSIFIED INCOME STATEMENT AT 30 SEPTEMBER 2019 (1)

(1) EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization): this is an economic indicator that is not defined in the IFRSs, but used by the company’s management to monitor and assess its operating performance, as this indicator is not influenced by the volatility deriving from the effects of the different criteria for determining taxable income, the amount and characteristics of capital employed, as well as the related amortisation and depreciation policies. This indicator is defined by Datalogic as Profit/Loss for the period before depreciation/amortisation of tangible and intangible assets, non-recurring costs, financial income and expense and income taxes.

RECLASSIFIED BALANCE SHEET AT 30 SEPTEMBER 2019(2)

(2) The reclassified balance sheet and financial analysis shows aggregations used by management to assess the Group's financial performance. These measures are generally adopted in the practice of financial communication, they are immediately referable to the accounting data of the primary financial statements, however they are not identified as accounting measures under the IFRS.

NET FINANCIAL POSITION AT 30 SEPTEMBER 2019(3)

(3) The NFP (Net Financial Position) or Net Financial Debt (NFD): this indicator is calculated in accordance with Consob Communication No. 15519 of July 28, 2006, also including "Other financial assets" represented by temporary investments of liquidity and financial liabilities for emerging operating leases following the application of the new accounting standard IFRS 16.