|

The progressive improvement in sales and margins continued in the third quarter:

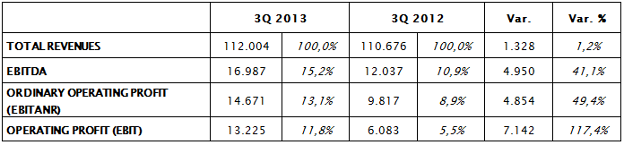

• Sales revenues at 112.0 million Euro , +1.2% compared to 110.7 million Euro in the third quarter of 2012

• EBITDA at 17.0 million Euro, +41.1% compared to 12.0 million Euro in the third quarter of 2012

• Net profit at 7.4 million Euro compared to 2.0 million Euro in the third quarter of 2012

• 9M2013 closes with a net profit of 17.7 million Euro compared to 28.6 million Euro registered in the first nine months of 2012

• Consolidated net financial debt at 125.1 million Euro compared to 121.1 million Euro at 31st December 2012

Bologna, 7th November 2013 – The Board of Directors of Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”) and global leader in the automatic data capture and industrial automation markets and producer of bar code readers, data collection mobile computers, sensors, vision systems and laser marking systems, approved today the Quarterly Financial Report at 30th September 2013.

The results of the quarter show encouraging signs compared to the previous year and to the second quarter of this year, while reflecting a seasonal effect and the cautious attitude of companies operating in the retail sector that were penalized by a substantial contraction in consumption in mature markets.

The Chairman and CEO of the Datalogic Group, Romano Volta commented: “We are satisfied with the results of the quarter registering a positive trend in both sales and, above all, margins. We want to underline the excellent results in the Industrial Automation segment, achieved thanks to the introduction of new products in the manufacturing and T&L sector. The overall improvement in profitability is accompanied by increasing investments in Research and Development that have reached almost 8% of the revenue making it possible to launch new products in all the reference markets. The increase in sales in the Asian and Latin American markets, which have grown respectively by 8% and 25%, is worthy of note as it demonstrates the effectiveness of the investments and the strategic choices made in these areas. The positive results of this quarter induce us to expect that the closure of the financial year should be in line with expectations”.

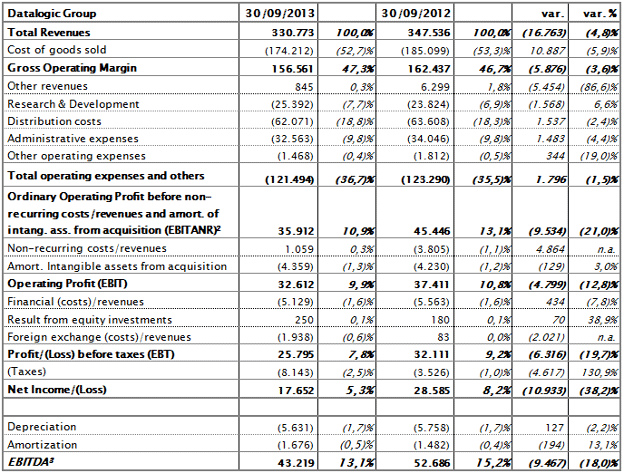

Sales revenues for the first nine months of 2013 came in at 330.8 million Euro compared to 347.5 million Euro of the first nine months of 2013 (-4.8% y/y and -3.5% at constant Euro/Dollar exchange rate).

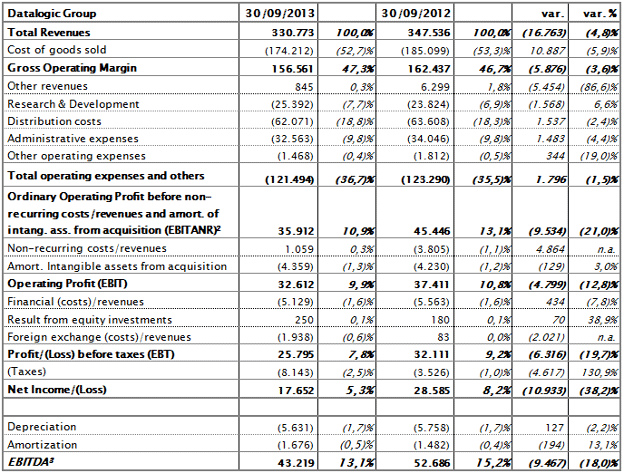

Over the first nine months of the year the gross operating margin, which was 156.6 million Euro compared to 162.4 million Euro for the same period in the previous year, improved as a percentage of total revenues from 46.7% to 47.3%.

EBITDA for the first nine months of 2013 was 43.2 million Euro compared to 52.7 million Euro the same period of last year (-18.0% y/y). This result benefited from approximately 5.5 million Euro in revenues related to the sale of some assets, such as patents, expertise and other intangible fixed assets related to a non-core business of the Group. It should be noted in addition that the Group has significantly increased investment in Research and Development both in absolute terms (from 23.8 million Euro as of the end of September 2012 to 25.4 million Euro as of the end of September 2013) and expressed as a percentage of revenue (from 6.9% to 7.7% in the respective 9 month periods) considering such investments as fundamental leverage for business development. The incidence of the EBITDA on revenues is 13.1% compared to15.2% for the first nine months of the previous year.

EBITANR[1] was 35.9 million Euro compared to 45.4 million Euro in the first nine months of 2012.

After financial charges of 5.1 million Euro compared to about 5.6 million Euro in the first nine months of 2012, foreign exchange costs for 1.9 million Euro compared to foreign exchange revenues for 0.08 million Euro in the same period of 2012 and taxes for about 8.1 million Euro compared to 3.5 million Euro in the first nine months of 2012, Group net profit came at 17.7 million Euro compared to 28.6 million Euro realized in the same period of the preceding year.

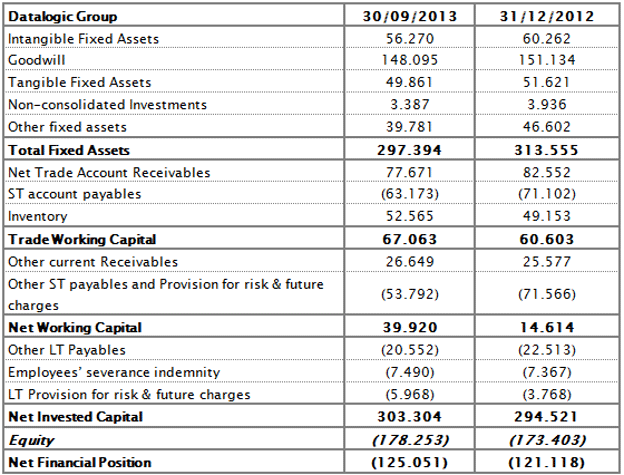

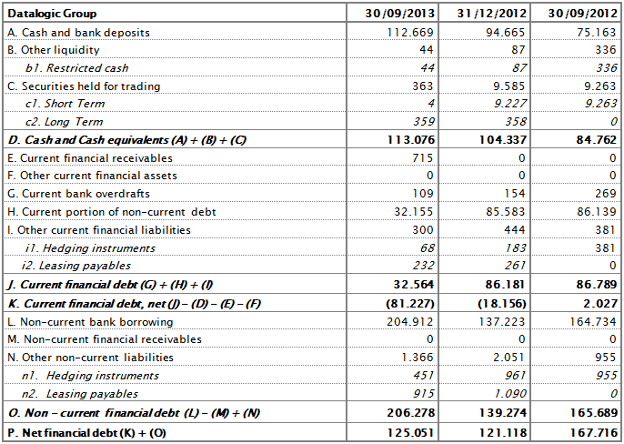

The net financial position on 30th September 2013 was negative at 125.1 million Euro, compared to 121.1 million Euro at 31st December 2012.

Trade working capital was 39.9 million Euro compared to 17.9 million Euro at 30th June 2013 and 14.6 million Euro at 31st December 2012.

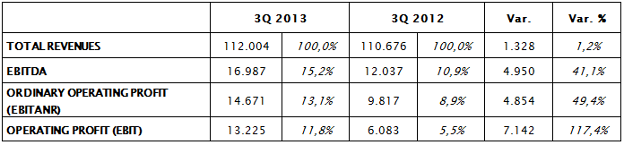

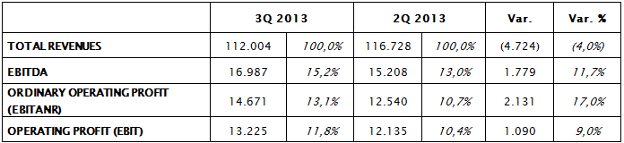

3Q2013

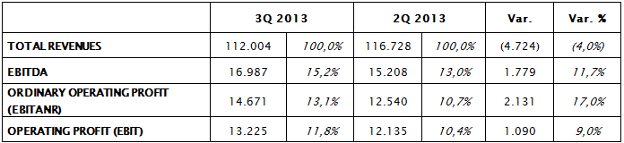

Sales revenues for an amount of 112 million Euro during the third quarter were up by 1.2% (+4.1% at constant exchange rates) compared to 110.7 million Euro for the same period in 2012 and down by 4% compared to 116.7 million Euro for second quarter of 2013 due to a seasonal effect.

The orders already received during the quarter were equal to 106 million Euro.

EBITDA shows a 41.1% growth from 12.0 million Euro in the third quarter of 2012 to 17 million Euro, with an increase of the percentage of EBITDA on revenues going from 10.9% to 15.2%. There is also a progressive improvement of 11.7% compared to 15.2 million Euro in the second quarter of 2013. The Operating Profit for an amount of 13.2 million Euro has more than doubled compared to 6.1 million Euro in the third quarter of 2012 and it has grown by 9% compared to the second quarter of the current year.

[1] EBITANR – Earnings before interest, taxes, acquisition and non recurring

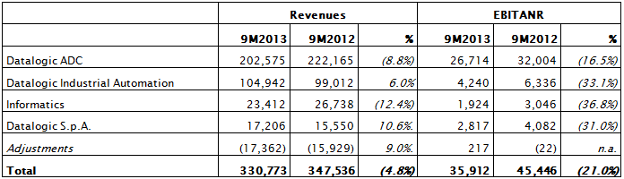

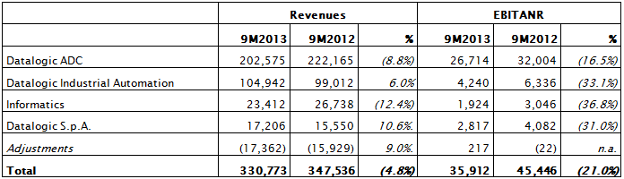

The following table shows individual operating divisions’ sales (inclusive of intersegment revenues) and EBITANR (earnings before interest, acquisition amortization and non-recurring items) for the first nine months of 2013 for the individual Operating Divisions.

The ADC Division (Automatic Data Capture) specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, registered revenues of 202.6 million Euro (222 million Euro in the same period of 2012). This division, in particular, is susceptible to the seasonal effect which is typical of the third quarter of the year and the macroeconomic "wait and see" trend of the retail sector that tends to postpone investments.

The Industrial Automation Division specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, registered revenues of 104.9 million Euro (99 million Euro in the same period of 2012). This division enjoyed the effect of a general recovery in terms of both revenues as well as margins compared to the previous year in all the reference sectors thanks to the launch of new innovative products such as the new dimensioner unit for the T&L sector.

At the end Informatics registered sales of 23.4 million Euro (26.7 million Euro in the same period of 2012).

Regarding geographic areas, in the first nine months of 2013, the European market continued to register a negative trend with approximately an 11% drop to 123.9 million Euro, followed by the North American market that registered a drop of 8% to 109.2 million Euro. On the other hand, sales continue to grow in the emerging markets in Asia and Latin America that have grown respectively by 8% to 42.8 million Euro and 25% to 25.9 million Euro.

PERIOD EVENTS

On 1st August an agreement was signed for the acquisition of the assets and the high power pulsed fibre laser technology based on the advanced “MOPA” system from Multiwave Photonics S.A., a Portuguese company based in Porto.

SUBSEQUENT EVENTS

There are no relevant events to report.

OUTLOOK FOR CURRENT YEAR AND SUBSEQUENT EVENTS

The results of the third quarter have been encouraging compared to the previous year (sales increased by 1.2% and EBITDA +41%) and notwithstanding a scenario that is still difficult in the main reference markets (especially the retail market), the company confirms its revenue forecast for the second semester, increased compared to the previous financial year.

***

Please note that the Interim Management Statement at 30th September 2013 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports - Mr Marco Rondelli – declares, pursuant to paragraph 2 of Art. 154-bis of the Italian Legislative Decree no.58/1998, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

Reclassified income statement at 30th September 2013 – Euro/1.000

Note: Following the introduction of IAS/IFRS, non-recurring or extraordinary costs are no longer shown separately in financial statements below the operating line but are included in ordinary operating figures. In order to ensure better representation of the Group’s ordinary profitability, we have preferred to show an operating result before the impact of non-recurring costs/income and acquisition-related amortization, which we have called "EBITANR - Earnings before interest, taxes, acquisition and non-recurring". To allow for comparison with the financial statements, we have provided an additional intermediate profit margin (the "operating result"), which includes non-recurring costs/income and amortisation due to acquisitions, and matches the figure reported in the financial statements.

[2] EBITANR – Earnings before interest, taxes, acquisition and non recurring

[3] EBITDA - Earnings before interest, taxes, depreciation and amortization

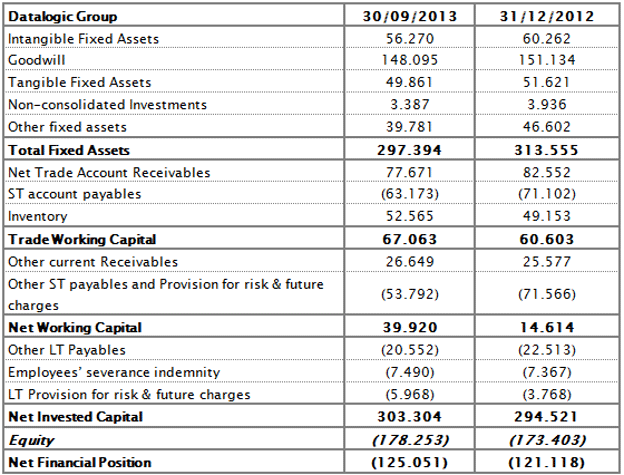

Reclassified Balance Sheet at 30th September 2013 – Euro/1.000

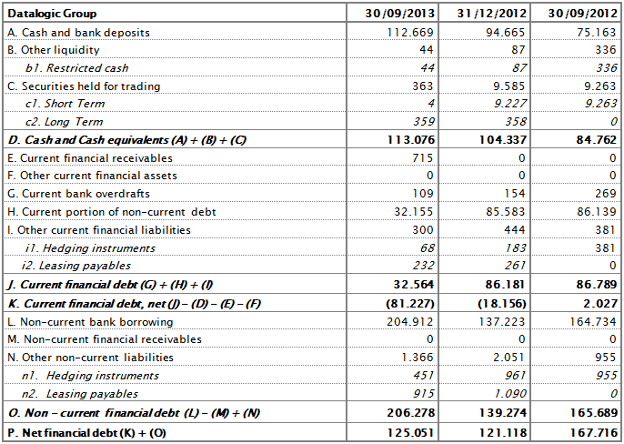

Net Financial Position at 30th September 2013 – Euro/1.000

|