Press Releases

Press Releases

The Board of Directors approves the Quarterly Financial Report at 30th September 2016. Confirmed growth of all economic indicators

- Sales revenues of 421.8 million Euro, a 7.8% increase, compared to 391.3 million Euro in the previous year (+7.9% at constant Euro/USD exchange rates)

- Growth in EBITDA, +25.5%, at 66.6 million Euro, compared to 53.1 million Euro in 9M 2015 (EBITDA Margin now 15.8%, up from 13.6%)

- Net profit of 40.9 million Euro, a 34.4% increase, compared to 30.4 million Euro in 9M 2015

- Net financial debt equal to 37.6 million Euro, compared to 54.8 million Euro as at 30th September 2015

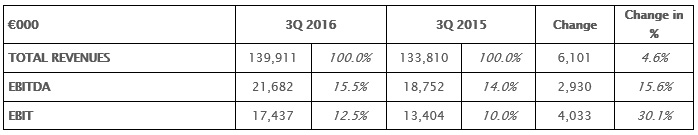

- Third quarter highlights an improving trend in the key economic indicators: revenues +4.6% to 139.9 million Euro and EBITDA +15.6% to 21.7 million Euro compared to the 3Q15

Bologna, 11th November 2016 - Datalogic S.p.A. (Borsa Italiana S.p.A.: DAL), a company listed in the STAR Segment of the Italian Stock Exchange managed by Borsa Italiana S.p.A. (“Datalogic”), a global leader in Automatic Data Capture and Industrial Automation markets, and world-class producer of bar code readers, mobile computers, sensors for detection, measurement and safety, vision systems and laser marking equipment, approved today the Quarterly Financial Report at 30th September 2016.

Results for the first nine months confirm sharp growth of all economic indicators and continuation of the positive trend recorded in the first half of the year. Specifically, EBITDA recorded an improvement of 25.5% to 66.6 million Euro, with the margin up from 13.6% to 15.8%, despite the return to a more sustained level of investment in R&D in the third quarter and net profit rose to 40.9 million Euro, up by 34.4%.

The Chairman and CEO of the Datalogic Group, Romano Volta, commented: “We are very satisfied with the results achieved during the first nine months of the year, during which the Group's profitability has been at its highest levels in the last decade. Despite the seasonal nature of the third quarter and the tipical pre-electoral uncertainties in the United States, which has partly slowed growth in revenues, margins continue to benefit from measures to contain operating costs. During the quarter, investments in research and development returned to our physiological levels, optimal for the development of new products with high innovative content, such as the latest initiatives in the mobile segment, DL AXIST, Joya Touch and the new Shopevolution 7 software, which are receiving excellent feedback from our customers and which we expect to have a positive impact on sales. Implementation of the new process for reorganisation by verticals - Retail, Manufacturing, T&L and Healthcare - was also launched during the quarter, bringing us closer to the needs of our customers and further optimising our production processes, taking full advantage of market potential."

Sales revenues amounted to 421.8 million Euro, up by 7.8% compared to 391.3 million Euro in the first nine months of 2015 (+7.9% at a constant Euro/USD exchange rates). The booking amounted to 426.2 million Euro, up by 5.2% compared to the same period in 2015.

Gross Operating Margin, was up by 6.4% in absolute terms to 194.5 million Euro, compared to 182.7 million Euro the prior year (+6.5% at a constant Euro/USD exchange rates), while its impact on revenues decreased from 46.7% in the first nine months of 2015 to 46.1% in 2016.

Operating costs, equal to 140.5 million Euro, were essentially in line with the corresponding nine months of 2015 in absolute terms, while they showed a sharp improvement in terms of impact over turnover from 35.9% to 33.3%. This trend reflects measures aimed at containing general administrative expenses, to the benefit of the increase in Research and Development expenses, which grew by 5.4% to 36.6 million Euro and 8.7% of revenues. These costs highlight a higher impact on turnover during the quarter, equal to 8.8%, compared to 8.3% in second quarter of 2016, indicating a recovery of the postponement observed in the first part of the year. Also showing improvement were distribution expenses in terms of impact on turnover, declining from 19.1% in the first nine months of 2015, when they were influenced by higher investments due to strengthening of the distribution network in North America, to 17.8% for the current period, and essentially in line in terms of absolute value.

EBITDA grew by 25.5% to 66.6 million Euro, compared to 53.1 million Euro in the first nine months of 2015 (+25.7% at a constant Euro/USD exchange rates). The impact on revenues (EBITDA margin) was up by over 2 percentage points to 15.8%, compared to 13.6% in the first nine months of 2015.

EBIT was up by 38.5% to 52.8 million Euro compared to 38.1 million Euro (+38.7% at a constant Euro/USD exchange rates).

Following financial expenses of 2.6 million Euro, down compared to the 4.0 million Euro recorded in the first nine months of 2015, and exchange rate losses of 0.5 million Euro, compared to gains of 2.4 million Euro in the corresponding period of 2015, the Group's net profit amounted to 40.9 million Euro, up by 34.4% compared to 30.4 million Euro in the first nine months of 2015.

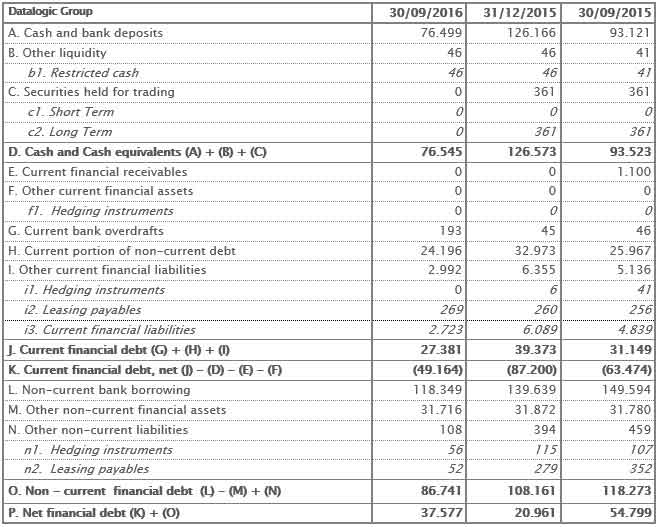

Net financial debt as at 30th September 2016 amounted to 37.6 million Euro, compared to 21.0 million Euro as at 31st December 2015 and 54.8 million Euro as at 30th September 2015.

Trade working capital amounted to 76.3 million Euro as at 30th September 2016, compared to 58.8 million Euro as at 30th September 2015.

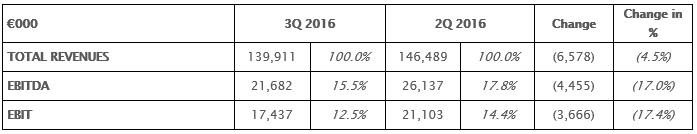

QUARTERLY PERFORMANCE

Sales revenues in the third quarter of 2016 amounted to 139.9 million Euro, up by 4.6% compared to the third quarter of 2015 (+4.8% at a constant Euro/USD exchange rates) and down by 4.5% compared to the second quarter of 2016, confirming the Group's positive performance despite the seasonal nature of this period of the year and the political uncertainty in the United States. The booking (already acquired orders) for the quarter is equal to 138.1 million Euro, up by 3.5% compared to the third quarter of 2015.

The impact of new products on turnover during the quarter was equal to 20.4%, compared to 27.4% in the second quarter.

EBITDA is equal to 21.7 million Euro, up by 15.6% compared to the third quarter of 2015 and down 17% compared to the year's second quarter, which benefited from higher growth in revenues and from the postponement of a number of R&D costs.

Comparison between third quarter 2016 and third quarter 2015

Comparison between third quarter 2016 and second quarter 2016

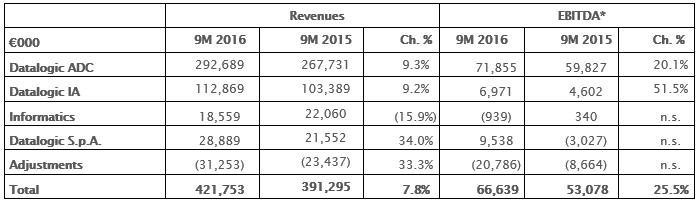

PERFORMANCE BY DIVISION

(*) With the purpose to better report the operating sectors economic performances, it was deemed appropriate to highlight the Divisional EBITDA as monitoring KPI.

The ADC (Automatic Data Capture) Division, specialized in the design and production of fixed retail scanners, professional handheld readers and mobile computers, recorded a turnover of 292.7 million Euro, up by 9.3% (+9.4% at a constant Euro/USD exchange rates) compared to the first nine months of 2015 and 97.9 million Euro in the third quarter, up by 8.4% (+8.6% at a constant Euro/USD exchange rates) compared to the third quarter of 2015. The double-digit growth trend in North and South America continued during the nine months, driven by the sale of fixed retail scanners with imaging technology and mobile computers.

EBITDA is up by 20.1% to 71.9 million Euro, with a margin of 24.6%, an increase of 2.3 percentage points compared to 22.3% during the corresponding period of the previous year, confirming the division's excellent performance as a result of improvement in operational leverage and containment of costs.

The Industrial Automation Division, specialized in the design and production of automatic identification systems, safety, detection and marking solutions for the Industrial Automation market, reported a turnover of 112.9 million Euro, up by 9.2% compared to the first nine months of 2015 (unchanged increase at a constant Euro/USD exchange rates) and 37.2 million Euro in the third quarter of 2016, highlighting slight growth compared to the third quarter of 2015. Net of the results of the Systems Business Unit, which was the subject of a spin off on 1st October, the Division's revenues increased by 5.4% to 99.1 million Euro (unchanged increase at a constant Euro/USD exchange rates).

In terms of revenues, double-digit growth was observed in Europe, thanks to the highly positive performance of bar code readers in the industrial segment and of safety light curtains.

EBITDA is up by 51.5% to 7 million Euro, with a margin of 6.2% (8.3% net of the Systems BU results), for an improvement of 1.7 percentage points compared to 4.5% in the first nine months of 2015.

Informatics reported a turnover of 18.6 million Euro, compared to 22.1 million Euro in the first nine months of 2015, down 15.9%. This performance was impacted by the recent organisational changes and the shift to a new business model that focuses on long-term services.

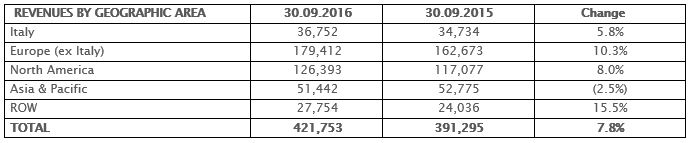

PERFORMANCE BY GEOGRAPHIC AREA

Looking at the geographical areas, the first nine months of the year showed highly positive performance in sales on the European market, including Italy, which is driving the trend, with revenues of 216.2 million Euro (+9.5%), while the North American market is growing at rates above the market, up by 8.0% to 126.4 million Euro.

PERIOD EVENTS

There are no relevant events to report.

EVENTS OCCURRING AFTER THE END OF THE QUARTER

The spin-off of the Systems Business Unit became effective on 1st October 2016. This operation involved the establishment, by Datalogic Automation Inc. (US subsidiary of the Company), of a newco - Solution Net Systems, Inc., with headquarters in Quakertown, Pennsylvania (USA) - into which all of the Systems BU's assets were transferred. Starting from said date, therefore, Solution Net Systems, Inc. will provide customers of the Datalogic Group with integrated solutions for automated distribution in the postal and retail segment, previously provided by the Systems Business Unit of the Industrial Automation division.

On 18th October, Alessandro D'Aniello was appointed new Group CFO and Manager responsible for drawing up the company's financial statements within the Datalogic Group.

A project was launched during the quarter with the aim of redefining all customer-oriented corporate processes of the Datalogic Group, with a view to becoming increasingly Customer Driven. Consequently, customers will benefit from maximum quality in terms of product and effectiveness of the services offered. We expect this project to render the corporate structure of the Datalogic Group more effective, thus improving Customer Satisfaction. The Project is indicatively expected to go live on 1st January 2017.

OUTLOOK FOR CURRENT YEAR

The results of the first nine months confirm the Group's positive performance. In particular, the ADC Division continues to boast steady growth in fixed retail scanners and mobile computers across all geographical regions. The Industrial Automation Division benefits from growth beyond expectations in Europe, while it is impacted by a continued reflective trend in the American market.

The Group will continue to make significant investments in R&D (already 8.7% of turnover), confirming innovation as a key pillar for Datalogic's future, rewarded by the growth in turnover from new products.

The positive nine-month booking performance and the traditionally positive trend of the last quarter makes us confident on the year-end results in terms of revenues, essentially in line with the growth trend of the first nine months.

***

Please note that the Interim Management Statement at 30th September 2016 is not audited and that it is available in the Investor Relations section of the company’s website: www.datalogic.com.

The manager responsible for preparing the company’s financial reports – Alessandro D’Aniello – declares, pursuant to paragraph 2 of Art. 154-bis of the “Testo Unico della Finanza”, that the accounting information contained in this press release corresponds to the document results, books and accounting records.

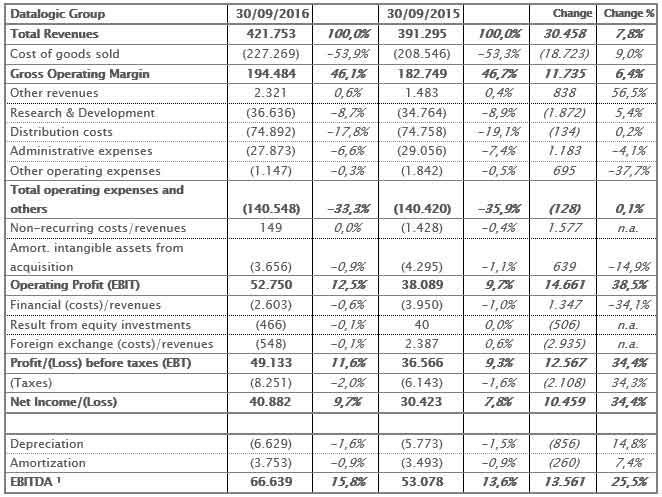

Reclassified income statement at 30th September 2016 – Euro/1.000

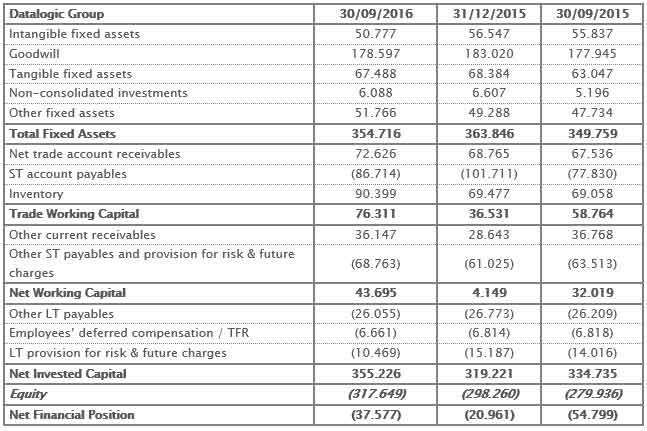

Reclassified Balance Sheet at 30th September 2016 ([2]) – Euro/1.000

Net Financial Position at 30thSeptember 2016 – Euro/1.000

[1] EBITDA - - Earnings before interest, taxes, depreciation and amortization.

The EBITDA is used by the Management to monitor and assess the operational performance of the Group and is not identified as an accounting item within IFRS. Given that the composition of this measure is not regulated by the reference accounting standards, it is not subject to any audit procedure by the Independent Auditors.

The EBITDA is used by the Management to monitor and assess the operational performance of the Group and is not identified as an accounting item within IFRS. Given that the composition of this measure is not regulated by the reference accounting standards, it is not subject to any audit procedure by the Independent Auditors.

[2] The reclassified Balance Sheet shows measures used by the Management to monitor and assess the financial performances of the Group. Given that the composition of these measures is not regulated by the reference accounting standards, even if they are directly reconcilable to the IFRS statements, they are not subject to any audit procedure by the Independent Auditors.